Key Factors to Impact Prologis' (PLD) Earnings This Season

Prologis, Inc. PLD is slated to report third-quarter 2018 earnings on Oct 16, before the opening bell.

In the last reported quarter, this industrial real estate investment trust (REIT) delivered an in-line performance in terms of funds from operations (FFO) per share. The company witnessed a weak top line in the quarter though period-end occupancy remained high.

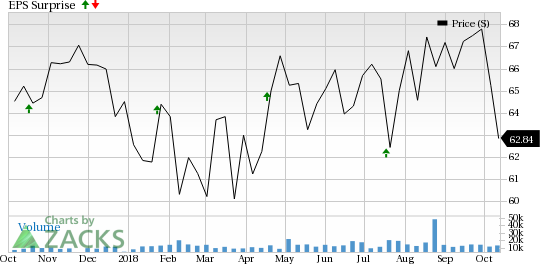

However, over the preceding four quarters, Prologis surpassed the FFO per share estimates in two occasions and met in the other two. This resulted in an average positive surprise of 2.41%. This is depicted in the graph below:

Prologis, Inc. Price and EPS Surprise

Prologis, Inc. Price and EPS Surprise | Prologis, Inc. Quote

The Zacks Consensus Estimate for the third-quarter FFO per share is currently pegged at 71 cents.

Let’s see how things are shaping up for this announcement.

Factors at Play

The industrial real estate market is firing on all cylinders, backed by an improving economy and job-market gains, strengthening e-commerce market and high consumption levels. Demand for warehouses, distribution centers and other industrial property remains strong, and continues to surpass supply levels. Per a study by the commercial real estate services firm — CBRE Group Inc. CBRE — availability fell for 33 straight quarters to 7.1% for the U.S. industrial real estate market in the Jul-Sep quarter. Notably, this denotes the lowest level since 2000.

Amid these, Prologis is well poised to capitalize on these growth opportunities aided by its capacity to offer modern distribution facilities at strategic in-fill locations. The company possesses decent balance-sheet strength and being a market leader, it has the ability to raise capital at favorable rates.

In the to-be-reported quarter, Prologis is expected to have enjoyed high occupancy of its properties and healthy rent levels. Also, the Zacks Consensus Estimate for the third-quarter rental revenues is currently pegged at $612 million, indicating 12.3% increase sequentially, which is encouraging.

Moreover, Prologis witnessed an eventful third quarter this year. The company finally completed the acquisition of DCT Industrial Trust Inc., in an $8.5-billion all-stock deal, including debt assumption. With this acquisition, Prologis added 71-million-square-foot area to its operating portfolio. This enabled the company to strengthen its foothold in major high-growth markets of Southern California, the San Francisco Bay Area, Seattle and South Florida.

The company enjoys high number of build-to-suit development projects which highlights the advantageous location of its land bank, as well as demand from Prologis’ multi-site customers, many of whom are focused on e-commerce. These sites are positioned in urban markets that are suited for serving as the last warehouse before goods are delivered to consumers.

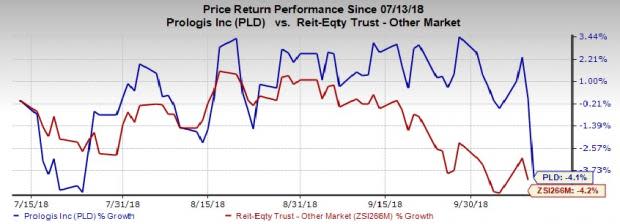

Nevertheless, recovery in the industrial market has continued for long and there is intense competition. Also, interest rate-hike issues create hiccups in the market. Amid these, the Zacks Consensus Estimate of FFO per share for the quarter under review remained unchanged at 71 cents over the past two months. However, the figure denotes a projected year-over-year increase of around 5.97%. Although shares of Prologis have declined 4.1% in the past three months compared to the 4.2% fall recorded by the industry, buying the stock would be a prudent decision given its bright prospects.

Here is what our quantitative model predicts:

Prologis has the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Prologis is +0.47%.

Zacks Rank: Prologis carries a Zacks Rank #2 (Buy), currently.

A positive Earnings ESP is a meaningful and leading indicator of a likely beat in terms of FFO per share. This, when combined with a favorable Zacks rank, makes us reasonably confident of a positive surprise.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Duke Realty Corporation DRE, slated to release third-quarter results on Oct 24, has an Earnings ESP of +2.56% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ventas, Inc. VTR, scheduled to release earnings on Oct 26, has an Earnings ESP of +1.59% and a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Duke Realty Corporation (DRE) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance