Some Kelso Technologies (TSE:KLS) Shareholders Have Taken A Painful 85% Share Price Drop

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Anyone who held Kelso Technologies Inc. (TSE:KLS) for five years would be nursing their metaphorical wounds since the share price dropped 85% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 46% over the last twelve months. The falls have accelerated recently, with the share price down 15% in the last three months. But this could be related to the weak market, which is down 19% in the same period.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Kelso Technologies

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

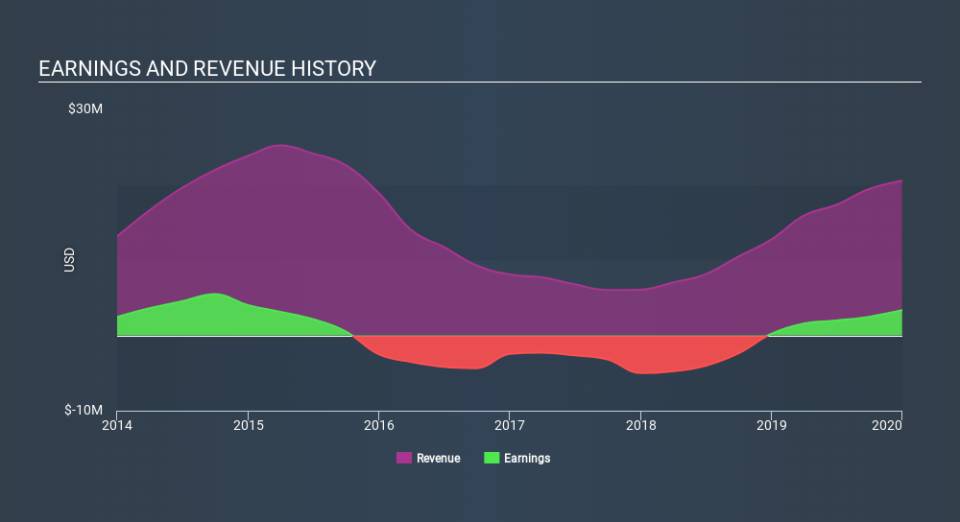

Kelso Technologies became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 9.9% per year is viewed as evidence that Kelso Technologies is shrinking. That could explain the weak share price.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Kelso Technologies shareholders are down 46% for the year. Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 31% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Kelso Technologies better, we need to consider many other factors. Even so, be aware that Kelso Technologies is showing 2 warning signs in our investment analysis , you should know about...

Of course Kelso Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance