This Just In: Analysts Are Boosting Their Cenovus Energy Inc. (TSE:CVE) Outlook for This Year

Cenovus Energy Inc. (TSE:CVE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance.

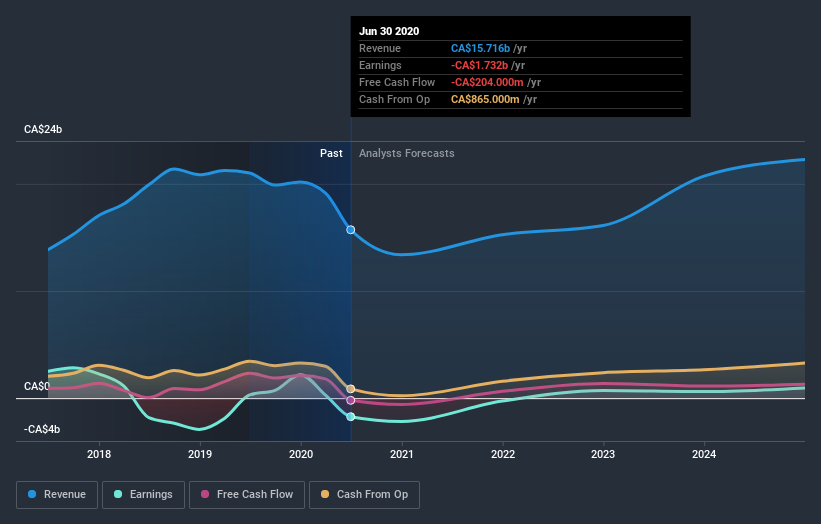

Following the latest upgrade, the current consensus, from the nine analysts covering Cenovus Energy, is for revenues of CA$13b in 2020, which would reflect a not inconsiderable 15% reduction in Cenovus Energy's sales over the past 12 months. Losses are expected to increase substantially, hitting CA$1.65 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of CA$12b and losses of CA$2.39 per share in 2020. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

Check out our latest analysis for Cenovus Energy

There was no major change to the consensus price target of CA$7.87, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Cenovus Energy, with the most bullish analyst valuing it at CA$11.00 and the most bearish at CA$5.25 per share. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast revenue decline of 15%, a significant reduction from annual growth of 11% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.4% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Cenovus Energy is expected to lag the wider industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Cenovus Energy's prospects. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Cenovus Energy could be a good candidate for more research.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Cenovus Energy going out to 2024, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance