The Juniper Networks (NYSE:JNPR) Share Price Has Gained 12% And Shareholders Are Hoping For More

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. For example, the Juniper Networks, Inc. (NYSE:JNPR), share price is up over the last year, but its gain of 12% trails the market return. However, the stock hasn't done so well in the longer term, with the stock only up 4.3% in three years.

See our latest analysis for Juniper Networks

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Juniper Networks actually shrank its EPS by 22%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

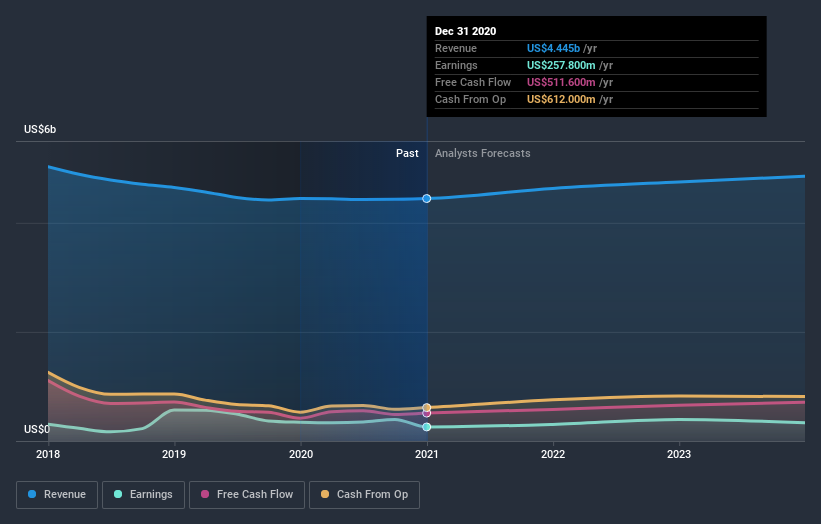

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Juniper Networks is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Juniper Networks stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Juniper Networks' TSR for the last year was 16%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Juniper Networks shareholders gained a total return of 16% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 4% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Juniper Networks better, we need to consider many other factors. To that end, you should be aware of the 4 warning signs we've spotted with Juniper Networks .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance