June Growth Opportunities – Pason Systems And More

Looking to add potential meaningful upside to your portfolio, but unsure where to start? Stocks such as Pason Systems and Eldorado Gold are considered to be high growth in terms of how much they’re expected to earn and return to shareholders, according to the market. Whether it be a well-known tech stock or a risky small-cap, I believe diversification towards growth can add value to your current holdings. Below I’ve compiled a list of stocks with a bright future ahead.

Pason Systems Inc. (TSX:PSI)

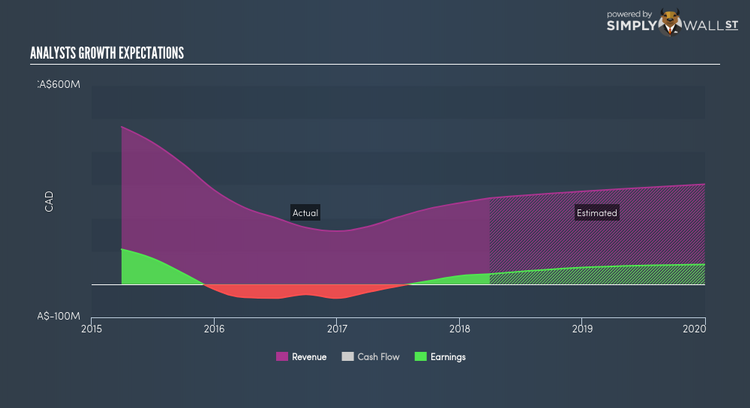

Pason Systems Inc. provides instrumentation data management systems for drilling rigs worldwide. Founded in 1978, and currently run by Marcel Kessler, the company provides employment to 610 people and with the stock’s market cap sitting at CAD CA$1.83B, it comes under the small-cap stocks category.

Could this stock be your next pick? I recommend researching its fundamentals here.

Eldorado Gold Corporation (TSX:ELD)

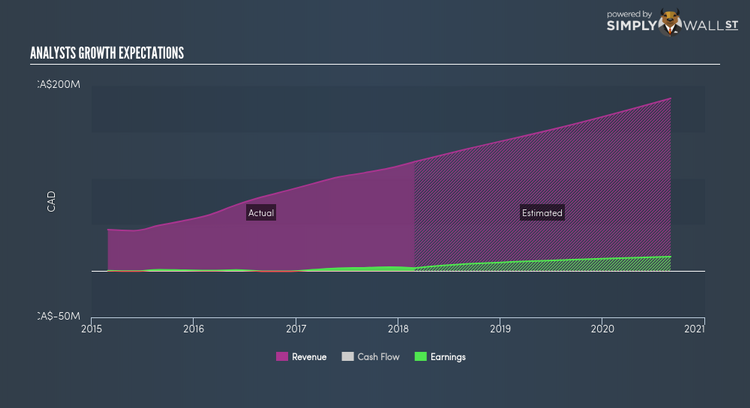

Eldorado Gold Corporation, together with its subsidiaries, engages in the exploration, development, and mining of gold properties in Turkey, Greece, Brazil, Serbia, Canada, and Romania. Established in 1992, and run by CEO George Burns, the company now has 2,729 employees and with the company’s market capitalisation at CAD CA$1.13B, we can put it in the small-cap stocks category.

Extreme optimism for ELD, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by a double-digit sales growth of 30.17%. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 0.11%. ELD’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add ELD to your portfolio? Check out its fundamental factors here.

People Corporation (TSXV:PEO)

People Corporation provides group benefits, group retirement, and human resource services in Canada. Founded in 2006, and now run by Laurie Goldberg, the company size now stands at 715 people and has a market cap of CAD CA$450.99M, putting it in the small-cap group.

PEO’s forecasted bottom line growth is an optimistic 49.33%, driven by the underlying double-digit sales growth of 45.43% over the next few years. It appears that PEO’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 12.82%. PEO’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Could this stock be your next pick? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance