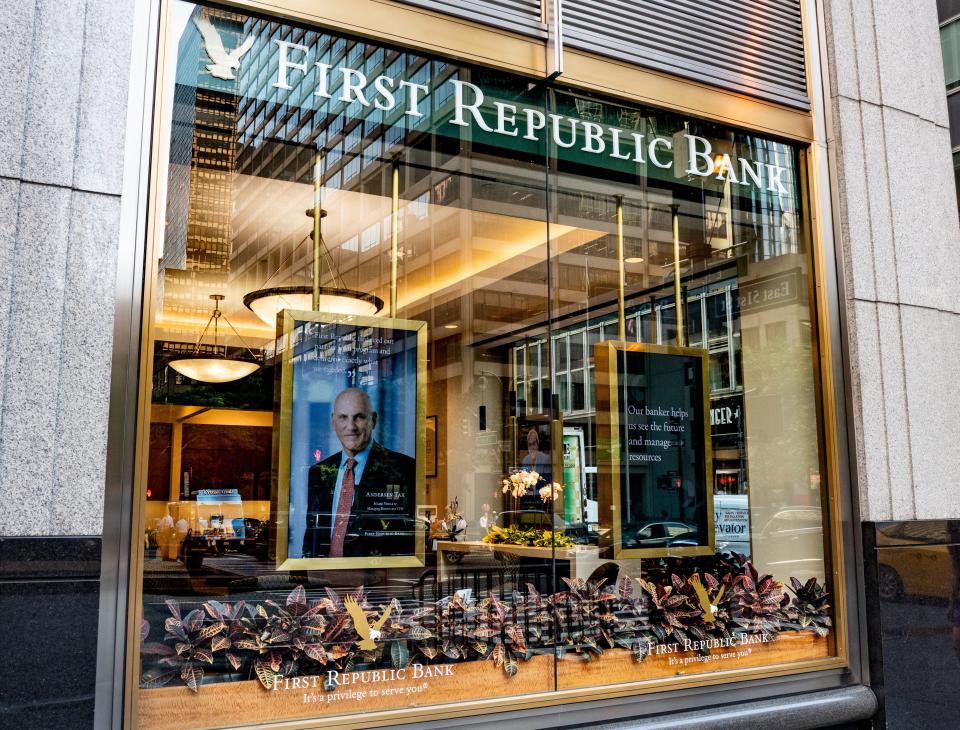

JPMorgan is buying First Republic Bank after it was taken over by regulators

First Republic Bank was put into receivership by regulators early Monday.

JPMorgan is taking over the failed lender and its deposits of almost $104 billion.

First Republic's failure is the second-largest in US history.

First Republic Bank will be taken over by JPMorgan after being seized by regulators, marking the third regional bank to be taken over by federal regulators following a consumer panic that took down Silicon Valley Bank in March.

It's the second-largest bank failure in US history.

The FDIC said early Monday that JPMorgan submitted a bid for all of First Republic's deposits, which stood at $103.9 billion as of April 13. JPMorgan said it was assuming deposits of about $92 billion, indicating that more customers had withdrawn funds from the lender after that date.

Deposits will continue to be insured by the FDIC, and customers do not need to change their banking relationship to retain their deposit insurance coverage up to applicable limits.

As part of the transaction, First Republic Bank's 84 offices in eight states will reopen as branches of JPMorgan on Monday.

The FDIC estimated that the cost to its Deposit Insurance Fund will be about $13 billion.

The takeover follows weeks of wrangling by First Republic and its investment banks, led by JPMorgan, for a solution to stay afloat. But no white knight buyer emerged as the stock continued to drop and talent fled.

"Our government invited us and others to step up, and we did," said Jamie Dimon, the CEO of JPMorgan, in a Monday statement. "Our financial strength, capabilities and business model allowed us to develop a bid to execute the transaction in a way to minimize costs to the Deposit Insurance Fund."

JPMorgan is assuming all of First Republic Bank's insured and uninsured deposits as well as most of its assets, the FDIC and JPMorgan said in their statements. JPMorgan is not assuming First Republic's corporate debt or preferred stock, however.

JPMorgan said it expected to recognize a one-off gain of $2.6 billion from the transaction. The bank also expects to run up $2 billion of restructuring costs over the next 18 months.

First Republic shareholders, who have seen the bank's stock lose more than 90% of its value in recent weeks, can expect to be wiped out.

Efforts to stabilize the San Francisco bank started after California regulators shuttered neighboring Silicon Valley Bank on March 10 following large consumer withdraws. Two days later, New York state regulators did the same with Signature Bank.

That same day, JPMorgan partnered with the Federal Reserve to offer $70 billion in financing to First Republic, its long-time client. First Republic's stock continued to plummet, however, resulting in a consortium of banks, led by JPMorgan, investing $30 billion in deposits into the bank on March 16.

The cash influx helped stabilize the bank — until this week when First Republic revealed the extent of its financial troubles during a first-quarter earnings report. The bank said deposits fell 41% to $104.5 billion in the first three months of 2023 and that it was taking steps to shore up its balance sheet, including cutting jobs and executive pay. It also said it was exploring its strategic options, industry jargon for a sale or spinoff.

First Republic tapped its longtime banker, JPMorgan, as well as Lazard and consulting giant McKinsey, to help find a solution, according to the Financial Times.

According to CNBC, First Republic's bankers have asked big banks to buy its loans above cost, arguing that they will have to pay for the regional bank's collapse via an estimated $30 billion in fees levied by the FDIC to cover its uninsured deposits.

During the pandemic, First Republic amassed a large book of loans that would be forced to take big haircuts if sold today to raise cash. According to Bloomberg, the bank offered rich people interest-only mortgages where the borrower didn't have to pay back any principal for the first decade of the loan.

In 2020 and 2021, according to Bloomberg's analysis, the bank extended nearly $20 billion of these no-interest loans just in San Francisco, Los Angeles, and New York. The outlet cited a Goldman Sachs executive who took out an $11.2 million mortgage with First Republic that required no principal payments for 10 years and an interest rate below 3%.

While such loans are expected to be paid off, selling them to raise cash to help cover the outflow of deposits would trigger significant losses.

First Republic's shares slumped on the news, sinking more than 40% to $2.10 in pre-market trading, while JPMorgan rose 2.5% to $141.70.

May 1, 2023, 4.40 a.m. ET: This story has been updated to include details from JPMorgan's statement.

May 1, 2023, 5.05 a.m. ET: This story has been updated to include First Republic and JPMorgan's share prices.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance