Jones Lang LaSalle (JLL) Q2 Earnings Beat Estimates, Stock Up

Shares of Jones Lang LaSalle Inc. JLL — popularly known as JLL — rallied 4.4%, during Tuesday's regular trading session, after the company reported a better-than-expected performance for second-quarter 2019.

The company reported second-quarter adjusted earnings of $2.94 per share, surpassing the Zacks Consensus Estimate of $2.33. The bottom-line figure also compared favorably with the year-ago adjusted earnings of $2.26 per share.

Revenues for the reported quarter came in at around $4.27 billion, outpacing the Zacks Consensus Estimate of $4.1 billion. The reported figure improved 9%, year over year. Moreover, fee revenues were up 9% year over year to $1.6 billion.

Results highlight robust Real Estate Services revenue growth. The company witnessed solid Americas’ leasing performance, while Corporate Solutions growth across all geographies boosted annuity base. Also, Capital Markets investment sales outpaced the decline in market volumes.

Behind the Headline Numbers

During the reported quarter, JLL’s Real Estate Services revenues climbed 9% year over year to $4.1 billion.

In the Americas, revenues and fee revenues came in at $2.5 billion and $863.9 million, respectively, indicating 14% and 12% year-over-year growth. Growth was strong and broad-based across all service lines. This was backed by Property & Facility Management mainly owing to the ramp-up of recent wins as well as expansion of existing facilities management relationships with U.S. Corporate Solutions clients. Additionally, leasing drove segment fee revenue growth backed by the Southeast and mid-Atlantic U.S. markets, and throughout all key asset categories. Further, solid growth in both investment sales and debt placement aided capital markets’ performance.

Revenues and fee revenues of the EMEA segment came in at $818.3 million and $379.9 million, down 3% and 2%, respectively, from the year-ago period. Results reflect softness in capital markets and leasing.

For the Asia-Pacific segment, revenues and fee revenues came in at $855.2 million and $262.9 million, respectively, marking year-over-year jump of 5% for both. Results suggest growth in revenues and fee revenues across all services lines that mirrored a double-digit increase in leasing, and growth in Property & Facility Management due to new client wins and expansion of existing client mandates.

Revenues from the LaSalle segment recorded an increase of 41% year over year to $129.4 million. This was contributed by higher incentive fees, associated with real estate dispositions in Asia Pacific on behalf of clients, and considerable growth in advisory fees. At the end of second-quarter 2019, assets under management were $68.4 billion, up 6% from $64.3 billion recorded at the end of the last quarter.

Liquidity

JLL exited the reported quarter with cash and cash equivalents of $411.2 million, up from the $389.5 million as of Mar 31, 2019. Moreover, the company’s net debt totaled $937.4 million as of June 30, 2019, denoting a decline of $42.7 million and $35.2 million from Mar 31, 2019, and Jun 30, 2018, respectively.

Our Viewpoint

We are impressed with JLL’s better-than-expected performance in the April-June quarter. The company has a diversified product & services range which helps register balanced revenue growth across its operating markets. Spate of strategic investment activities, in a bid to capitalize on market consolidations, are anticipated to boost long-term profitability. Furthermore, the company completed its acquisition of HFF Inc on Jul 1. This cash-and-stock transaction, valued at about $1.8 billion, is part of JLL’s effort to substantially boost its Capital Markets business.

JLL currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

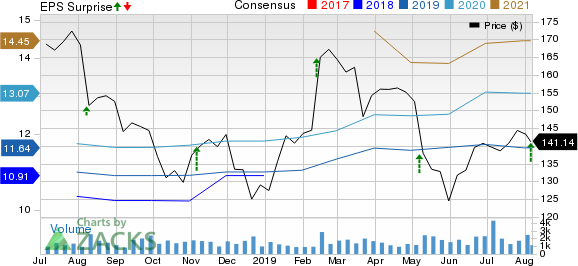

Jones Lang LaSalle Incorporated Price, Consensus and EPS Surprise

Jones Lang LaSalle Incorporated price-consensus-eps-surprise-chart | Jones Lang LaSalle Incorporated Quote

Competitive Landscape

Earlier CBRE Group Inc. CBRE reported second-quarter adjusted earnings per share of 81 cents, comfortably beating the Zacks Consensus Estimate of 78 cents. The figure also compared favorably with the prior-year quarter’s 74 cents. Results indicate strong revenue growth, driven by leasing, occupier outsourcing and U.S. capital markets.

We now look forward to the earnings releases of Brookfield Asset Management BAM and The RMR Group Inc. RMR. Brookfield Asset Management is slated to release quarterly numbers on Aug 8, while RMR Group will announce its results on Aug 9.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brookfield Asset Management Inc (BAM) : Free Stock Analysis Report

The RMR Group Inc. (RMR) : Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance