Johnson Controls (JCI) Q2 Earnings In Line, '22 EPS View Cut

Johnson Controls International plc JCI reported adjusted second-quarter fiscal 2022 earnings per share of 63 cents, in line with the Zacks Consensus Estimate and up nearly 21% year over year. The company reported adjusted revenues of $6,098 million, up 9% year over year. The top line, however, missed the Zacks Consensus Estimate of $6,138 million amid lower-than-expected sales across all segments but the Global Products.

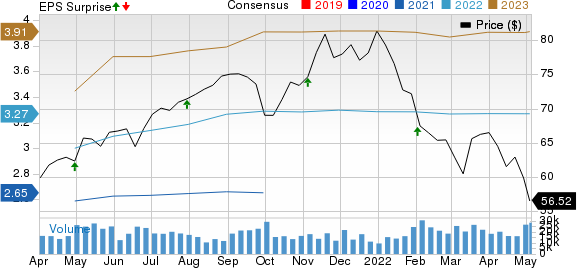

Johnson Controls International plc Price, Consensus and EPS Surprise

Johnson Controls International plc price-consensus-eps-surprise-chart | Johnson Controls International plc Quote

Segmental Results

Building Solutions North America: This segment’s adjusted revenues came in at $2,227 million, up 6% from the year-ago quarter’s $2,092 million on growth in HVAC & Controls platform. The metric, however, missed the Zacks Consensus Estimate of $2,269 million. The segment’s adjusted EBITA decreased to $235 million from $266 million reported in second-quarter fiscal 2021 and also lagged the consensus mark of $291 million.

Building Solutions Europe, Middle East, Africa/Latin America: Revenues from this segment totaled $958 million, up 3% year over year with double-digit growth in Service, and robust performance in Fire & Security platforms. The metric, however, missed the consensus mark of $967 million. The segment’s adjusted EBITA came in at $90 million, up from $88 million in the comparable year-ago period but falling short of the consensus mark of $97 million.

Building Solutions Asia Pacific: Revenues grew to $623 million, up 5% year over year on higher project installations and services, driven by strong growth in Commercial Applied HVAC & Controls and Industrial Refrigeration equipment. The metric missed the consensus mark of $656 million. The segment’s adjusted EBITA came in at $74 million, up nearly 1% but lagged the consensus mark of $76 million.

Global Products: Revenues in this segment climbed to $2,290 million, increasing 16% year over year, mainly on higher sales in Commercial and Residential HVAC and Fire & Security. The figure also outpaced the consensus mark of $2,217 million. The segment’s adjusted EBITA came in at $369 million, up around 30% year over year, aided by operational efficiency, favorable product mix and higher sales. The metric also beat the Zacks Consensus Estimate of $345 million.

Financial Position

Johnson Controls had cash and cash equivalents of $1,787 million as of Mar 31, 2022. Long-term debt marginally decreased to $7,366 million. Free cash flow in first-quarter fiscal 2022 was negative $193 million. During the reported quarter, Johnson Controls completed more than $500 million in share repurchases.

Guidance

For third-quarter fiscal 2022, Johnson Controls expects adjusted EPS in the range of 82-87 cents per share. It forecasts organic revenue growth in the high single digits on a year-over-year basis. Adjusted segment EBITA margin is anticipated to decline 80-100 basis points on a year over year basis.

JCI has downwardly revised its fiscal 2022 guidance, given the delayed backlog conversion amid supply chain disruptions. For fiscal 2022, adjusted EPS expectation is in the band of $2.95-$3.05, implying an 11-15% jump on a year-over-year basis but down from the prior guided range of $3.22-$3.32. Organic sales growth is envisioned in the range of 8-10% year over year. Adjusted segment EBITA margin is expected to decline 0-0.3% year over year.

Zacks Rank & Key Picks

Currently, Johnson Control carries a Zacks Rank #3 (Hold).

Some better-ranked players in the Industrial Products sector include Patrick Industries PATK, Beazer Homes USA BZH and NVR, Inc. NVR, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Patrick Industries is a leading component solutions provider for the RV, marine, and manufactured housing industries. PATK also services other industrial markets including single and multi-family housing, hospitality, institutional and commercial. Patrick Industries, like many others in the broader RV and consumer marine space, is in the midst of a massive run of revenue growth that began about a decade ago.

Patrick Industries’ expected earnings growth rate for 2022 is 30.2%. The Zacks Consensus Estimate for current-year earnings has improved 14.1% over the past seven days.

Beazer Homesdesigns, builds and sells single-family homes. BZH designs homes to appeal primarily to entry-level and first move-up homebuyers. Beazer Homes USA’s objective is to provide customers with homes that incorporate quality and value. BZH’s subsidiary, Beazer Mortgage, originates the mortgages for the company's homebuyers.

Beazer Homes’ expected earnings growth rate for fiscal 2022 is 49.3%. The Zacks Consensus Estimate for current-year earnings has improved 15% over the past seven days.

NVRis engaged in the construction and sale of single-family detached homes, townhomes and condominium buildings, all of which are primarily constructed on a pre-sold basis. In order to serve homebuilding customers, NVR operates a mortgage banking and title services business. NVR operates in two business segments: Homebuilding and Mortgage Banking.

NVR’s expected earnings growth rate for the current year is 68.4%. The Zacks Consensus Estimate for current-year earnings has improved 6.5% over the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson Controls International plc (JCI) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Patrick Industries, Inc. (PATK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance