Jazz's (JAZZ) Q4 Earnings Miss Estimates, New Drugs Drive Sales

Jazz Pharmaceuticals JAZZ reported an adjusted loss of 7 cents per share in fourth-quarter 2022, missing the Zacks Consensus Estimate for earnings of 51 cents. In the year-ago quarter, Jazz reported earnings of $4.21 per share.

Total revenues in the reported quarter rose 8.4% year over year to $972.1 million. The upside was driven by sales of new drugs and drugs added from the acquisition of GW Pharmaceuticals. Total revenues, however, slightly missed the Zacks Consensus Estimate of $972.7 million.

Net product sales increased 8.4% from the year-ago quarter’s levels to $967.5 million. Royalties and contract revenues were up 19.5% to $4.6 million in the quarter.

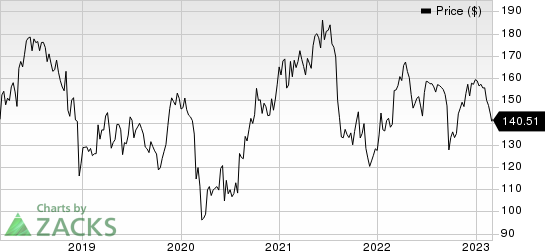

In the year so far, Jazz’s shares have declined 11.8% against the industry’s rise of 2.7%.

Image Source: Zacks Investment Research

Neuroscience Products

Sales of Jazz’s neuroscience products increased 8.0% to $740.6 million.

Net product sales for the combined oxybate business (Xyrem + Xywav) increased 12% to $528.9 million in the quarter. During the quarter, average active oxybate patients rose 11% year over year to approximately 18,000.

Sales of the sleep disorder drug Xyrem declined 14.0% year over year to $247.5 million due to patients switching to Xywav. Earlier this January, an authorized generic version of Xyrem was launched and management expects more generic launches later this year.

Xywav, a low-sodium formulation of Xyrem, recorded sales of $281.4 million in the quarter, up 54.0% year over year and 9.9% sequentially. The upside can be attributed to the encouraging uptake of the drug in narcolepsy and idiopathic hypersomnia (IH) indications. Following the fourth-quarter results, Xywav became Jazz’s largest product by net sales.

Sales of the epilepsy drug Epidiolex/Epidyolex rose 7% to $207.0 million. The drug was added to Jazz’s pipeline with the GW Pharmaceuticals’ acquisition in 2021. Jazz is making significant progress related to the launch of Epidyolex in Europe and other ex-U.S. markets.

Another drug added with the GW Pharma acquisition was Sativex, a cannabis-based mouth spray for multiple sclerosis-related spasticities, approved in Europe but not in the United States. The drug recorded sales of $4.7 million in the quarter, up 1.5% year over year.

Oncology Products

Oncology product sales increased 8.0% to $223.9 million.

New drug Rylaze recorded sales of $81.0 million in the quarter, up 25% year over year and 10.1% sequentially. Jazz stated that demand remained strong during the quarter. Rylaze is only approved in the United States for treating acute lymphoblastic leukemia (ALL) and lymphoblastic lymphoma (LBL) patients. A regulatory application seeking approval for this ALL drug was filed in Europe in May 2022.

Zepzelca, approved for small cell lung cancer, recorded sales worth $72.0 million in the quarter, up 11% year over year. Per management, the drug continued to be the treatment of choice in the second-line small cell lung cancer (SCLC) setting.

Acute myeloid leukemia drug, Vyxeos, generated sales of $30.3 million, down 12.9% from the year-ago period’s levels.

Defitelio sales were down 4.4% year over year at $40.7 million in the quarter.

Cost Discussion

Adjusted selling, general and administrative (SG&A) expenses were down 2.7% to $319.8 million due to lower Sunosi-related costs.

Last year, Jazz sold the worldwide rights to the narcolepsy drug Sunosi to Axsome Therapeutics AXSM. Upon closing the deal, Jazz received an upfront payment of $53 million from Axsome. In addition, Jazz is also entitled to receive royalties on U.S. net sales of Sunosi from Axsome. Axsome began selling Sunosi in the U.S. market in May 2022 and in certain international markets in November 2022.

Adjusted research and development (R&D) expenses rose 14.3% to $160.1 million, mainly due to support for the increased costs for developing pipeline candidates.

Full-Year 2022 Results

Jazz reported adjusted earnings of $13.20 per share in 2022, down 18.7% year over year.

Total revenues in the reported quarter rose 18% year over year to $3.7 billion. The total revenues included neuroscience and oncology revenues of $2.8 billion and $873.8 million, respectively.

2023 Guidance

The company expects 2023 adjusted earnings in the range of $16.90 - $17.85 per share.

Total revenues are expected to be in the range of $3.68-$3.88 billion, suggesting approximately 3% year-over-year growth at the midpoint compared with 2022 levels. In 2023, Jazz expects continued growth in net sales of Xywav, Epidiolex and its oncology portfolio.

Neuroscience sales are expected in the range of $2.68-$2.83 billion, implying flat year-over-year growth at the midpoint compared to 2022. The Oncology franchise is expected to record sales in the range of $0.95-$1.05 billion, indicating growth of 14.4% at the midpoint compared to 2022.

While adjusted SG&A expenses are anticipated between $1.05 billion and $1.11 billion, adjusted R&D expenses are expected to be in the band of $675 million to $725 million.

Jazz Pharmaceuticals PLC Price

Jazz Pharmaceuticals PLC price | Jazz Pharmaceuticals PLC Quote

Zacks Rank & Other Stock to Consider

Jazz currently has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the overall healthcare sector include Allogene ALLO and Amarin Corporation AMRN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allogene’s stock has increased 0.8% in the year-to-date period. Allogene’s loss estimates for 2023 have narrowed from $2.84 to $2.83 per share in the past 60 days.

Allogene beat earnings estimates in each of the last four quarters, the average surprise being 8.33%. In the last reported quarter, the company delivered an earnings surprise of 7.04%.

Amarin’s stock has surged 70.3% in the year so far. Amarin’s loss estimates for 2023 narrowed from 8 cents per share to 6 cents in the past 60 days.

Amarin beat earnings estimates in two of the last four quarters and missed the mark on the other two occasions, the average negative surprise being 14.29%. In the last reported quarter, Amarin’s earnings beat estimates by 100.00%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Amarin Corporation PLC (AMRN) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance