Jazz (JAZZ) Begins Zepzelca Combo Study for First-Line SCLC

Jazz Pharmaceuticals plc JAZZ announced that it enrolled the first patient in IMforte phase III study to evaluate its cancer drug Zepzelca (lurbinectedin) with Roche’s RHHBY Tecentriq (atezolizumab), a first-line maintenance treatment for patients with extensive-stage small cell lung cancer (ES-SCLC).

Jazz is collaborating with Roche in the IMforte phase III study to evaluate the safety, efficacy and pharmacokinetics of the combination of Zepzelca and Tecentriq for ES-SCLC, following the induction therapy with carboplatin, etoposide and atezolizumab.

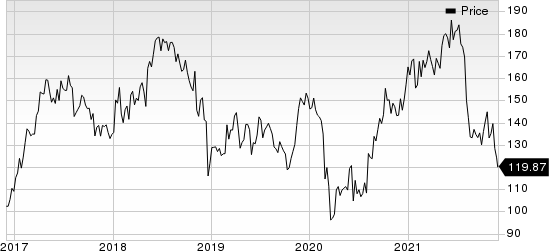

Shares of Jazz have declined 27.4% so far this year compared with the industry’s 19.4% fall.

Image Source: Zacks Investment Research

The primary objective of this study is to determine the ability of Zepzelca plus Tecentriq in improving the outcomes for ES-SCLC patients over the standard-of-care first-line maintenance treatments as measured by progression-free survival and overall survival.

Jazz plans to seek label expansion in the United States for Zepzelca combined with Tecentriq to treat the given indication following a potential success of the IMforte phase III study. A successful label expansion will help boost revenues of its oncology portfolio.

We remind investors that Zepzelca is already approved in the United States under the accelerated pathway for treating relapsed small cell lung cancer (SCLC) in adult patients. A confirmatory study to support the continued approval for Zepzelca will start by 2021 end. Zepzelca already generated sales worth $181.9 million from the beginning of 2021 through the September quarter.

Tecentriq is Roche’s leading immuno-oncology drug for multiple indications. The same is approved in the European Union and the United States for previously-treated metastatic non-small cell lung cancer and certain types of untreated or previously-treated metastatic urothelial carcinoma. Tecentriq is also approved for the first-line treatment of ES-SCLC. Besides, Roche is evaluating Tecentriq in other cancer indications, both as a monotherapy and in combinations.

In a separate press release, Jazz along with partner PharmaMar announced that Zepzelca is commercially available in Canada as a treatment for adult patients with Stage III or metastatic SCLC. Earlier in September, Health Canada had granted conditional approval to Zepzelca for treating adults with Stage III or metastatic SCLC.

Jazz had first in-licensed the U.S. commercialization rights to lurbinectedin from Pharma Mar in December 2019.

Jazz Pharmaceuticals PLC Price

Jazz Pharmaceuticals PLC price | Jazz Pharmaceuticals PLC Quote

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #3 (Hold). Two better-ranked stocks in the overall healthcare sector are Endo International ENDP and IVERIC bio ISEE. While Endo International sports a Zacks Rank #1 (Strong Buy), IVERIC bio carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Endo International’s earnings estimates per share for 2021 have increased from $2.32 to $2.84 in the past 30 days. The same for 2022 has increased from $2.25 to $2.47 in the past 30 days.

Earnings of Endo International beat estimates in all the last four quarters, delivering a surprise of 57.7%, on average.

IVERIC bio’s loss per share estimates for 2021 have narrowed from $1.18 to $1.12 in the past 30 days. The same for 2022 has narrowed from $1.17 to $1.10 in the past 30 days. Shares of IVERIC bio have gained 111.6% in the year so far.

IVERIC bio’s earnings missed estimates in three of the last four quarters and surpassed expectations once, the negative surprise being 5.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Endo International plc (ENDP) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

IVERIC bio, Inc. (ISEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance