Jack Henry (JKHY) Earnings & Revenues Beat Estimates in Q4

Jack Henry & Associates, Inc. JKHY delivered fourth-quarter fiscal 2019 earnings of 79 per share, which surpassed the Zacks Consensus Estimate by 2 cents and surged 2.6% on a sequential basis. However, the figure declined 9.2% from the year-ago quarter.

Year-over-year decline in the bottom line can primarily be attributed to customers’ preference of outsourced delivery over on-premise solutions which led to lower license and in-house implementation revenues during the reported quarter.

Revenues advanced 3.5% sequentially and 4% year over year to $.393.51 million. The figure also outpaced the Zacks Consensus Estimate of $391 million.

Further, as per the company reported, non-GAAP revenues came in $385.3 million, up 4% year over year and 3.6% from the previous quarter.

The top line was driven by solid performance of core and payments segments during the reported quarter.

Coming to the price performance, shares of Jack Henry have returned 9.7% on a year-to-date basis, underperforming the industry’s rally of 9.9%.

We believe Jack Henry’s continued core customer wins and robust new payment platform will aid the stock to rebound in the near term.

Segments in Detail

Core: The company generated $136.5 million revenues from this segment (34.7% of total revenues), increasing 5.2% year over year. This was primarily driven by strong adoption the company’s core solutions, which aided it in entering into 15 new core customer contracts. Further, it signed 25 existing in-house core customers for migrating to private cloud services during the reported quarter.

Payments: This segment yielded $141.1 million revenues (35.9% of total revenues), improving 6% from the year-ago quarter.

Complementary: This segment generated $105.1 million revenues (26.7% of total revenues), increasing 2.1% year over year.

Corporate & Other: The company generated $10.8 million revenues from this segment (2.7% of total revenues), declining 13% from the prior-year quarter.

Operating Details

In the fourth-quarter fiscal 2019, total operating expenses were $314.1 million, reflecting an increase of 7% year over year. This can primarily be attributed to rising headcounts, which led to an increase in personnel costs and salaries. Further, surge in selling, general and administrative expenses added to expenses.

Per the company reported, operating margin was 20%, expanding 200 bps year over year.

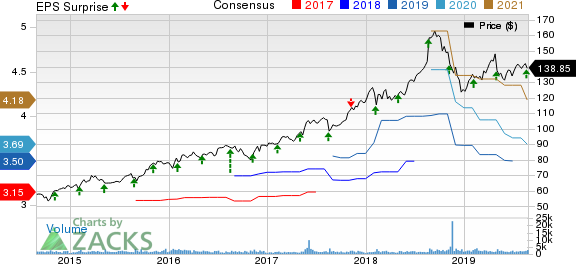

Jack Henry & Associates, Inc. Price, Consensus and EPS Surprise

Jack Henry & Associates, Inc. price-consensus-eps-surprise-chart | Jack Henry & Associates, Inc. Quote

Balance Sheet & Cash Flow

As of Jun 30, 2018, cash and cash equivalents totaled $93.6 million, which improved from $35.4 million as of Mar 31, 2019. Trade receivables were nearly $310.1 million, up from $190.8 million in the previous quarter.

Further, the company generated $431.1 million of cash from operations in fiscal 2019, increasing from $421.1 million in fiscal 2018.

Additionally, free cash flow came in $260.5 million in the reported year.

Guidance

For fiscal 2020, the company anticipates total revenues growth between 6.5% and 7%. The Zacks Consensus Estimate for revenues is projected at $1.66 billion.

The company anticipates sustaining solid momentum across processing customers. Further, continued core customer wins remain a major positive.

However, migration of existing in-house customers to private clouds will continue to impact license and in-house segmentation revenues negatively.

Further, the earnings per share are expected to lie within the range of $3.60-$3.64. The Zacks Consensus Estimate for earnings is pegged at $3.69.

Zacks Rank & Stocks to Consider

Currently, Jack Henry carries a Zacks Ranks #3 (Hold).

Some better-ranked stocks in the broader technology sector are Ringcentral, Inc RNG, Garmin Ltd. GRMN and LogMein, Inc LOGM. While Ringcentral and LogMein sport a Zacks Rank #1 (Strong Buy), Garmin carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Ringcentral, Garmin and LogMein is currently pegged at 16.32%, 7.35% and 5%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report

LogMein, Inc. (LOGM) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Jack Henry & Associates, Inc. (JKHY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance