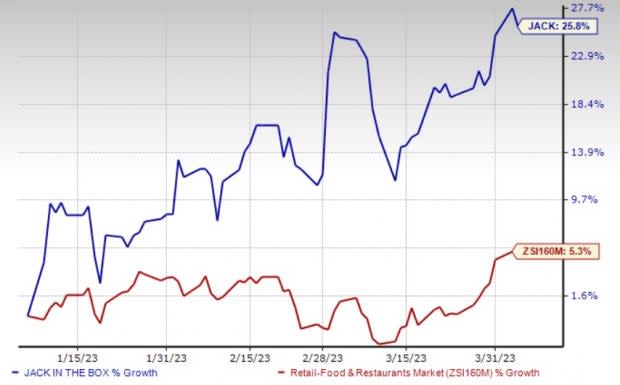

Jack in the Box (JACK) on Fire: Outpaces Industry in 3 Months

Jack in the Box Inc. JACK have jumped 25.8% in the past three months compared with the industry’s growth of 5.3%. The company is benefiting from menu innovations, robust digitalization and the Del Taco merger.

The Zacks Rank #2 (Buy) company has an impressive long-term earnings growth rate of 17%. In the past 30 days, earnings estimates for 2023 have witnessed upward revisions of 0.3% to $5.82 per share.

Let’s delve deeper.

Growth Drivers

Menu innovation is one of the primary characteristics of JACK’s brand. The company is continuously working on maintaining the uniqueness of its brand, menu and premium food offerings. In the first quarter of fiscal 2023, it focused on menu inventions with products like Bacon Cheeseburger and Deluxe Grilled Chicken Sandwich.

It also unveiled the $10 Fan Favs platform and Jack Pack combo. In terms of beverage offerings, the company started enhancements with products like The Basic Witch Shake, The Frozen Hot Cocoa Shake and the Red Bull-infusion line. The company intends to focus on expanding its caffeine-based drinks to drive growth.

Jack in the Box is also increasingly focusing on delivery channels, which is a growing area for the industry. Given the high demand for this service, the company has undertaken third-party delivery channels to bolster transactions and sales. It partnered with DoorDash, Postmates, Grubhub and Uber Eats.

The company is expanding its mobile application in a few markets that support order-ahead functionality and payment. Going forward, it will continue to integrate its POS systems with third-party vendors to enhance restaurant operations.

In first-quarter fiscal 2023, the company emphasized on simplifying its operations through equipment, technology and process enhancements. In the quarter, JACK reported encouraging results with respect to the fryer automation. It stated that addition of a location (Dallas) is in the pipeline.

Image Source: Zacks Investment Research

The company also reported meaningful progress related to the expansion of three-in-one toaster cheese pumps and Hydro-Rents machines. JACK anticipates Hydro-Rents coverage to touch 50% across the JACK system by mid-April 2023. The company expects the initiatives to reduce complexity and improve efficiencies (or cost pressures) in the upcoming periods.

JACK is also benefiting from the Del Taco merger. The company believes that, along with paving the path for improvement in restaurant margins, store-level profitability and strengthening of capital structure, this merger will help mitigate macroeconomic headwinds.

Jack in the Box anticipates the deal to be accretive to earnings per share (excluding transaction expenses) in the mid-single digit in a year. In the second year, the company expects meaningful accretion of earnings once full synergies are realized. With this integration, the company anticipates realizing run-rate cost synergies of $15 million by 2023-end.

Other Key Picks

Some other top-ranked stocks in the Zacks Retail-Wholesale sector are Chuy's Holdings, Inc. CHUY, Arcos Dorados Holdings Inc. ARCO and Bloomin' Brands, Inc. BLMN.

Chuy’s Holdings currently sports a Zacks Rank #1 (Strong Buy). CHUY has a trailing four-quarter earnings surprise of 19.1%, on average. Shares of the company have gained 47.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Chuy’s Holdings’ 2023 sales and EPS suggests growth of 10.8% and 19%, respectively, from the year-ago period’s reported levels.

Arcos Dorados currently flaunts a Zacks Rank #1. ARCO has a long-term earnings growth rate of 7.8%. Shares of the company have declined 8.3% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2024 sales and EPS suggests growth of 8% and 11.4%, respectively, from the year-ago period’s reported levels.

Bloomin' Brands sports a Zacks Rank #1 at present. BLMN has a long-term earnings growth rate of 12.3%. The stock has risen 23% in the past year.

The Zacks Consensus Estimate for Bloomin' Brands’ 2024 sales and EPS suggests growth of 2.4% and 5.5%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Bloomin' Brands, Inc. (BLMN) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance