IRAN VOWS REVENGE FOR SANCTIONS — It will not cut production

Reuters

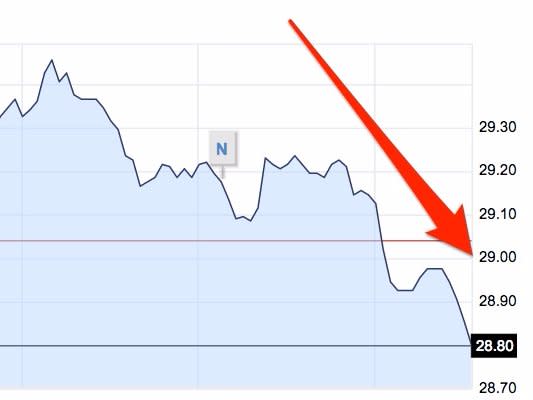

Oil prices are tumbling because the agreement between Saudi Arabia, Russia, Qatar, and Venezuela to freeze oil production at January levels looks like it is going to have little effect.

Basically, the markets would be happier if Saudi Arabia promised to cut — not freeze — production, and if Iran and Iraq joined the countries in pledging to put their output levels on ice.

However, it looks like that won't happen anytime soon judging by comments made by Iran’s OPEC envoy, Mehdi Asali, to the Iranian daily newspaper Shargh.

“Asking Iran to freeze its oil production level is illogical … when Iran was under sanctions, some countries raised their output and they caused the drop in oil prices,” said Asali, as cited by Reuters and the BBC. “How can they expect Iran to cooperate now and pay the price?”

Iran has only just had its sanctions lifted and it is not looking at reducing the amount it can produce while it is trying to rebuild its battered economy with lucrative oil reserves. Oil production constitutes 23% of Iran's wealth, according to Trading Economics. There is no love lost between Iran and the Saudis. And the Iranians are going to put their own economy before the interests of the Russians and the Venezuelans.

So refusing to join in the freeze is basically Iran saying "screw you!" to the oil world.

Crude oil prices are currently at below $30 per barrel. That's a massive drop from the $100-plus highs of the summer of 2014. Analysts believe that the deal between Saudi Arabia, Russia, Qatar, and Venezuela is only prolonging the pain of low prices. The only benefit it brings is the promise of not making things even worse.

ReutersIn fact, the International Energy Agency said in its latest oil market report that OPEC members

pumped out 280,000 more barrels every day in January than in December, helped largely by Iran's re-entry into the global markets after the lifting of sanctions that month.

Since then, Iran has increased production by 80,000 barrels a day to 2.99 million, the IEA says.

Julia Sturgeon and her team at Macquarie released a research note on Wednesday morning saying how integral Iran is to an oil price recovery:

The deal is contingent on a broader agreement among OPEC members, and we do not expect Iran to agree to the deal as it stands. In our view, there would need to be a concession for Iran to allow for some recovery towards production at pre-sanction levels.

On Tuesday, Capital Economics Middle East economist Jason Tuvey argued in a note to clients that an "output freeze [is] not a game-changer for the Gulf economies." Production from Russia, Qatar, and Venezuela wasn't expected to rise much anyway, and Iraq and Iran are not mentioned in this agreement.

ReutersAccording to Barclays analysts Miswin Mahesh and Kevin Norrish,

Iranian exports are already inching higher after the removal of sanctions (though exports are still below pre-sanction levels), and comments from Iran's vice president suggest that the country's exports have expanded to 1.3 million barrels a day and are expected to reach 1.5 million barrels a day around March 20.

Jonathan Aronson and his team at Credit Suisse also point out that "naysayers" see oil prices tumbling further (emphasis ours):

In this view, a freeze of production is not a 'confidence builder' but an admission that despite the historic collapse of oil prices the sovereign producers cannot find enough common ground. For instance, Iran reiterated that it intends to grow its output back to pre-sanctions level.

So really, Iran has suddenly regained a lot of its power in the world, and isn't inclined to hold back.

NOW WATCH: According to Consumer Reports, these are the best car brands for 2016

See Also:

Oil prices are falling as OPEC squabbles over production targets

Saudi Arabia's oil minister says a production cut 'is not going to happen'

SEE ALSO: Saudi Arabia's oil production freeze is making prices slide

Yahoo Finance

Yahoo Finance