Is IQVIA Holdings's (NYSE:IQV) Share Price Gain Of 156% Well Earned?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is IQVIA Holdings Inc. (NYSE:IQV) which saw its share price drive 156% higher over five years.

View our latest analysis for IQVIA Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, IQVIA Holdings actually saw its EPS drop 14% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

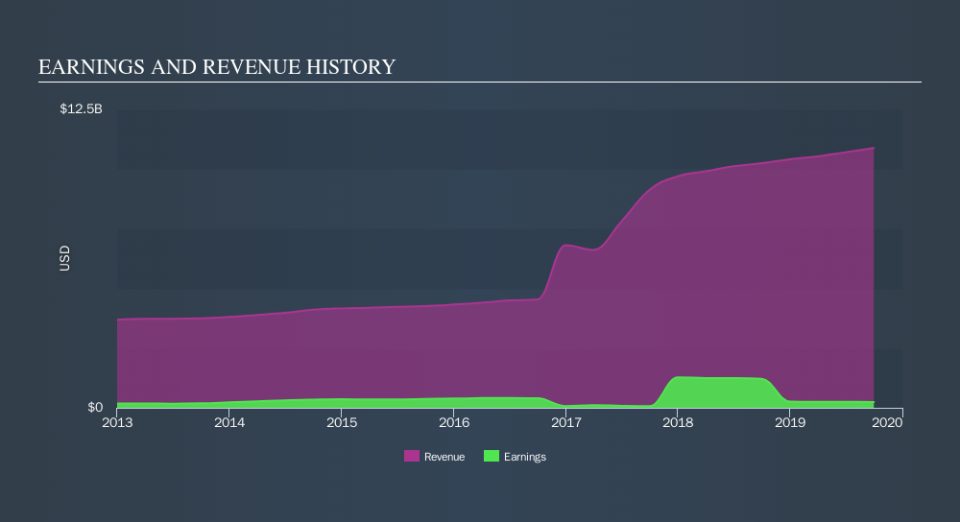

On the other hand, IQVIA Holdings's revenue is growing nicely, at a compound rate of 24% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

IQVIA Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling IQVIA Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that IQVIA Holdings shareholders have received a total shareholder return of 21% over the last year. However, the TSR over five years, coming in at 21% per year, is even more impressive. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course IQVIA Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance