Ionis' (IONS) Angelman Syndrome Drug Gets FDA's Orphan Tag

Ionis Pharmaceuticals IONS recently announced that the FDA has granted orphan drug designation and rare pediatric disease designation to ION582, its investigational antisense medicine for the treatment of Angelman syndrome, a rare neurogenetic disorder. The candidate is being developed in collaboration with Biogen BIIB.

An orphan drug designation is granted by the FDA to the candidates developed to treat, diagnose or prevent a rare disease or condition. This FDA designation makes the sponsor eligible to receive seven years of market exclusivity, following the potential approval and tax credit for qualified clinical studies.

If a candidate is granted rare pediatric disease designation by the FDA, then upon potential approval of the drug, the sponsor is eligible to receive a priority review voucher (“PRV”). This PRV can be used either by the sponsor by itself in a subsequent marketing application filed with the FDA for a different product or may even be sold to another to boost cash reserves.

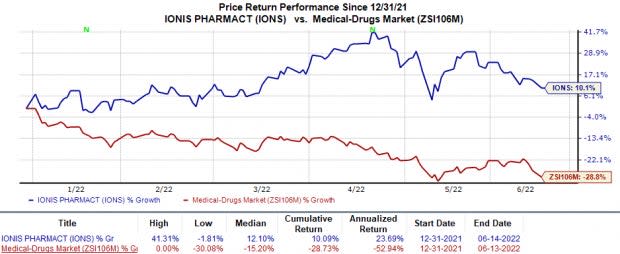

In the year so far, shares of Ionis have risen 10.1% against the industry’s 28.7% decline.

Image Source: Zacks Investment Research

Angelman syndrome is caused by the loss of function of the maternally inherited Ubiquitin Protein Ligase E3A (UBE3A) gene. People with this disorder suffer severe developmental delays in motor, language and cognitive functioning from an early age, resulting in complete dependence on the caregiver. An estimated one in 12,000 to 20,000 people across the globe are affected by this disorder.

Currently, there are no disease-modifying treatments for Angelman syndrome. An antisense medication, ION582, has been designed to target the UBE3A transcript or UBE3A-Antisense Transcript (UBE3A-ATS) for the potential treatment of Angelman Syndrome. The candidate is currently being evaluated in phase I/II study to assess the safety, tolerability and activity of multiple ascending doses.

Another company developing a candidate for treating Angelman Syndrome is Ultragenyx Pharmaceutical Inc. RARE. GTX-102, RARE’s candidate for the disorder, is being evaluated in phase I/II study currently enrolling patients. Ultragenyx plans to provide an interim update on the safety and efficacy of the candidate by mid-2022.

Ionis and BIIB entered into a collaboration to develop ION582 in 2012. Apart from ION582, Biogen and Ionis are also collaborating on advanced treatments for neurological disorders.

Biogen and Ionis’ drug Spinraza is approved for treating spinal muscular atrophy in pediatric and adult patients. While Biogen is responsible for commercializing Spinraza worldwide, Ionis received royalties from Biogen on Spinraza’s sales.

Ionis Pharmaceuticals, Inc. Price

Ionis Pharmaceuticals, Inc. price | Ionis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Ionis currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Sesen Bio SESN, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sesen Bio’s loss per share estimates for 2022 has declined from 33 cents to 32 cents in the past 60 days. Shares of SESN have fallen 20.8% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance