Investors in Real Brokerage (CVE:REAX) have made a impressive return of 201% over the past year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the The Real Brokerage Inc. (CVE:REAX) share price has soared 201% return in just a single year. Also pleasing for shareholders was the 86% gain in the last three months. We'll need to follow Real Brokerage for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

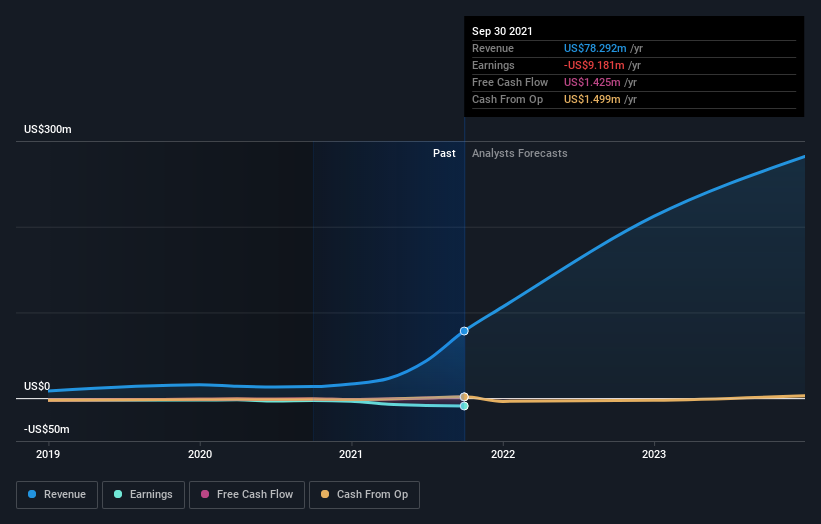

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Real Brokerage

Real Brokerage wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Real Brokerage saw its revenue grow by 483%. That's a head and shoulders above most loss-making companies. Meanwhile, the market has paid attention, sending the share price soaring 201% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Real Brokerage stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Real Brokerage shareholders should be happy with the total gain of 201% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 86% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Real Brokerage that you should be aware of before investing here.

But note: Real Brokerage may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance