Investors Prefer Safe USD to Avoid Risks

“Trade wars” issue was quite calm in June until the US President Donald Trump announced new import duties on Chinese goods, from different equipment and technics to highly-specialized products. In total, the effect of this decision is expected to be 50 billion USD. It is known that duties will be increased in two stages, the first of which is scheduled to start on July 6th. China immediately responded and said that it would make it up to the USA and do the same, but also include soy and meat (pork) to the list.

Not long time ago it seemed that “trade wars” between the USA and China slowed down, in words at least. However, Trump was again speaking about low competitiveness of American goods due to a great number of Chinese replacements available on the market. This is what forced the USA to be aggressive in its commercial relations because there was no other way to “reboot” the production and economic affairs inside the American economy. Well, no other way that is less complicated and expensive.

Another reason why the USD is feeling confident is the European Central Banks’ decision to expand the QE program until the end of December 2018 instead of closing it in September, like was planned earlier. In addition to that, the European regulator is planning to keep the key interest rate unchanged at least until the next summer. By the way, on Monday evening, the ECB Governor Mario Draghi is scheduled to deliver his speech and investors should pay attention to the things he is going to say.

The USD will remain strong as long as market players have to “dodge” a lot of risks, such as the OPEC, “trade wars”, and the difference in benchmark rates.

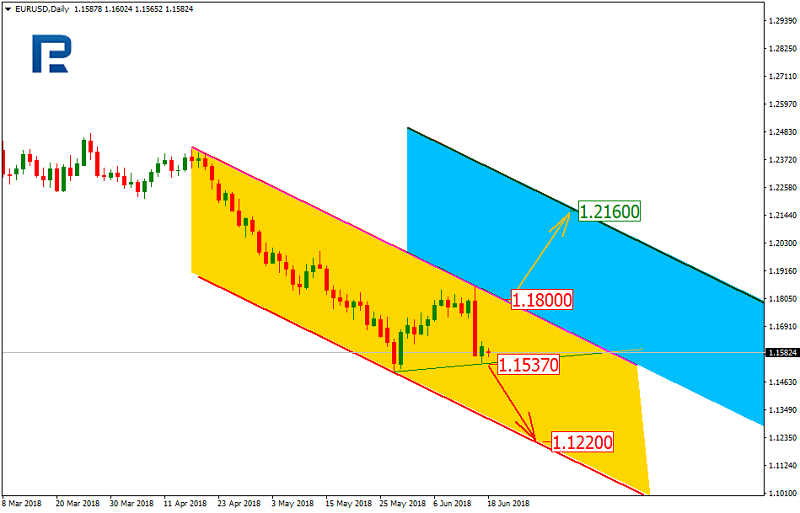

At the moment, it’s better to analyze EURUSD on weekly and daily charts in order to understand market sentiment better on different timeframes. In the weekly chart, the pair broke the support line of the long-term uptrend not long times ago and started a new descending phase. After breaking the line, the price quickly moved into the downside projected channel and reached the target support area. Right now, we can see the instrument testing this area to break it. However, according to the other scenario, the price may rebound from it. If the price does break the current support area, it may continue falling towards 1.1080. Otherwise, in case the correction continues, the instrument will continue moving between support and resistance levels at 1.1510 and 1.1830 respectively.

The daily chart shows the downtrend. After testing the resistance line, the current rising impulse hasn’t been able to break the previous low, which means that it is not ready to continue the decline. Only after breaking 1.1537, the pair may fall towards 1.1220. In case the price breaks the current resistance line and 1.1800, the instrument may move into the upside projected channel and head towards its resistance line and 1.2160 in particular.

This article was written by Dmitriy Gurkovskiy, a Chief Analyst at RoboForex

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance