Should Investors Consider Palo Alto Networks Shares Post-Split?

While most market headlines in 2022 have carried a negative sentiment, several companies have given investors plenty of reasons to remain positive, one being stock splits.

Stock splits are always a thrilling development that any investor can get excited about.

Of course, a split has no effect on a company's market capitalization.

But it reduces the value of each share, making it easier for the stock price to multiply and provide investors with significant gains.

In 2022, we’ve witnessed several market titans undergo stock splits, including the mighty Tesla TSLA, Amazon AMZN, and Alphabet GOOGL.

However, one that seemingly flew under the radar was Palo Alto Networks’ PANW three-for-one stock split in mid-September.

The announcement was a part of the company’s latest quarterly report, and it was a strong one - Palo Alto reported quarterly earnings of $2.39 per share, easily surpassing the Zacks Consensus EPS Estimate of $2.28 and reflecting a 5% bottom-line beat.

Quarterly revenue was reported at $1.5 billion, marginally above expectations and good enough for a substantial 27% Y/Y uptick.

The quarterly results impressed the market; shares tacked on 12% in value the following trading day.

It raises a valid question: should investors take a closer look at PANW shares? Let’s find out.

Share Performance

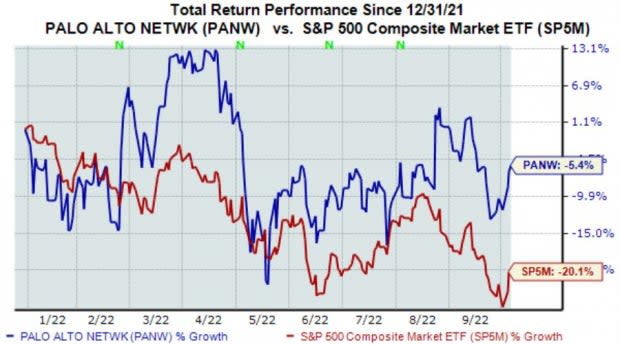

PANW shares have been notably defensive in 2022, declining 5.4% vs. the general market’s roughly 20% decline.

Image Source: Zacks Investment Research

Upon widening the timeframe to encompass the last five years, we can see that PANW shares have provided market-beating returns for quite some time.

Image Source: Zacks Investment Research

PANW weathering a dark fiscal cloud better than most technology stocks in 2022 is undoubtedly a major positive, and shares have easily crushed the S&P 500 over a longer-term timeframe.

Growth Estimates

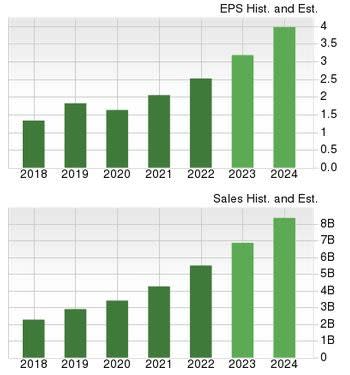

Palo Alto Networks carries a loaded growth profile; the Zacks Consensus EPS Estimate of $3.15 for the company’s current fiscal year (FY23) suggests Y/Y earnings growth of 25%.

And in FY24, PANW’s bottom line is projected to tack on an additional 21% of growth.

The earnings growth comes on top of forecasted Y/Y revenue growth for FY23 and FY24 of 24.8% and 21.2%, respectively.

Image Source: Zacks Investment Research

Valuation

The company’s shares are undoubtedly expensive, bolstered by its Value Style Score of D.

Further, PANW’s 7.6X forward price-to-sales ratio is a tick above its five-year median of 7.5X and represents a steep 114% premium relative to its Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

However, steep valuation multiples are typical of stocks with a high-growth profile, a vital aspect that investors should know.

Bottom Line

PANW’s three-for-one split is a huge positive for shareholders, with the barrier of entry for potential investors taken down a few notches.

Still, with technology companies carrying a higher risk level, many investors could be scared off, especially in 2022.

However, PANW shares have been notably strong in 2022, easily outpacing the general market. In addition, the company carries a favorable growth profile coming off of a robust quarterly report.

Valuation levels are undoubtedly steep, concluding that the stock may not be suited for more conservative investors.

For those with a high-risk tolerance and a long-term timeframe, Palo Alto Networks’ PANW growth trajectory seems almost impossible to ignore.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance