Investors Who Bought K92 Mining (CVE:KNT) Shares A Year Ago Are Now Up 231%

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example K92 Mining Inc. (CVE:KNT). Its share price is already up an impressive 231% in the last twelve months. Also pleasing for shareholders was the 56% gain in the last three months. Also impressive, the stock is up 222% over three years, making long term shareholders happy, too.

See our latest analysis for K92 Mining

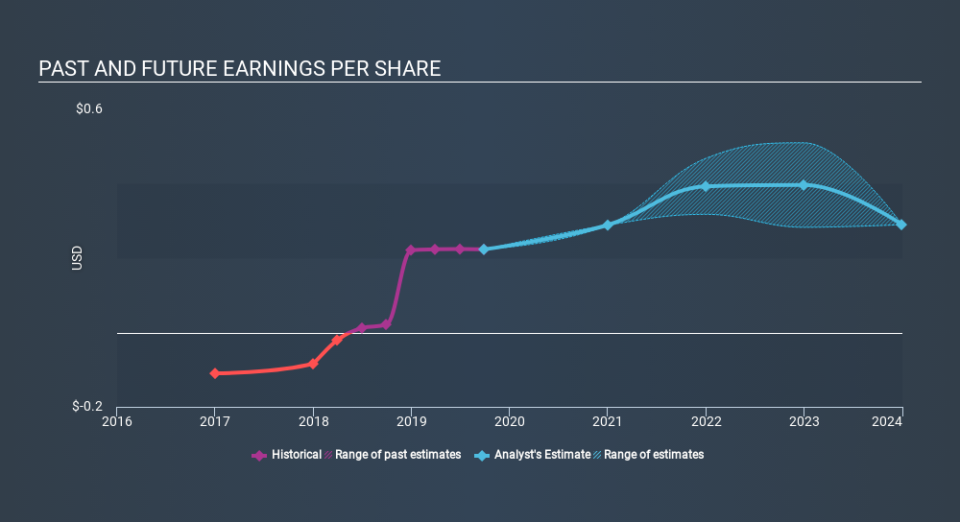

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

K92 Mining boasted truly magnificent EPS growth in the last year. This remarkable growth rate may not be sustainable, but it is still impressive. So we'd expect to see the share price higher. To us, inflection points like this are the best time to take a close look at a stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of K92 Mining's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that K92 Mining rewarded shareholders with a total shareholder return of 231% over the last year. That gain actually surpasses the 48% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting K92 Mining on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with K92 Mining (including 1 which is is concerning) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance