Investing in GURU Organic Energy (TSE:GURU) a year ago would have delivered you a 87% gain

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the GURU Organic Energy Corp. (TSE:GURU) share price is 87% higher than it was a year ago, much better than the market return of around 38% (not including dividends) in the same period. So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for GURU Organic Energy

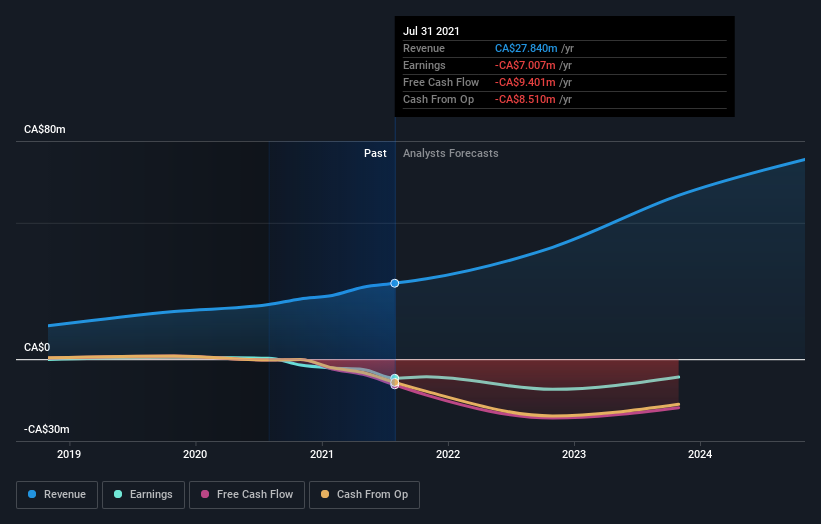

Because GURU Organic Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, GURU Organic Energy's revenue grew by 39%. We respect that sort of growth, no doubt. While the share price performed well, gaining 87% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling GURU Organic Energy stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

GURU Organic Energy boasts a total shareholder return of 87% for the last year. Unfortunately the share price is down 4.0% over the last quarter. Shorter term share price moves often don't signify much about the business itself. It's always interesting to track share price performance over the longer term. But to understand GURU Organic Energy better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with GURU Organic Energy (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

GURU Organic Energy is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance