Introducing Stampede Drilling (CVE:SDI), The Stock That Slid 64% In The Last Five Years

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Stampede Drilling Inc. (CVE:SDI) share price dropped 64% over five years. That's an unpleasant experience for long term holders. Unhappily, the share price slid 2.5% in the last week.

Check out our latest analysis for Stampede Drilling

Given that Stampede Drilling didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Stampede Drilling saw its revenue shrink by 1.4% per year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 18% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

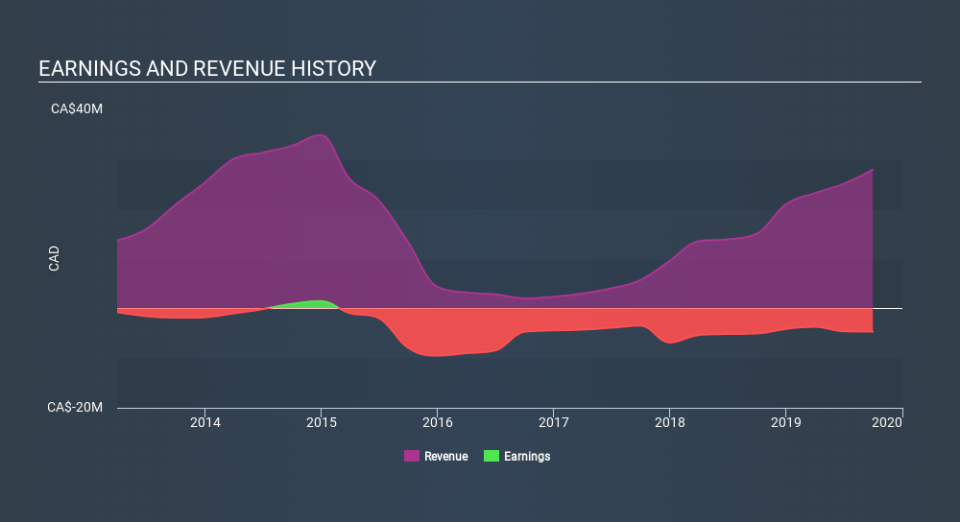

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Stampede Drilling's earnings, revenue and cash flow.

A Different Perspective

Stampede Drilling shareholders are down 2.5% for the year, but the market itself is up 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 18% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Stampede Drilling better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Stampede Drilling (including 2 which is don't sit too well with us) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance