Introducing RYB Education (NYSE:RYB), The Stock That Slid 67% In The Last Year

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held RYB Education, Inc. (NYSE:RYB) over the last year knows what a loser feels like. The share price has slid 67% in that time. RYB Education hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The good news is that the stock is up 3.6% in the last week.

Check out our latest analysis for RYB Education

Because RYB Education is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year RYB Education saw its revenue grow by 10%. That's not a very high growth rate considering it doesn't make profits. It's likely this muted growth has contributed to the share price decline of 67% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

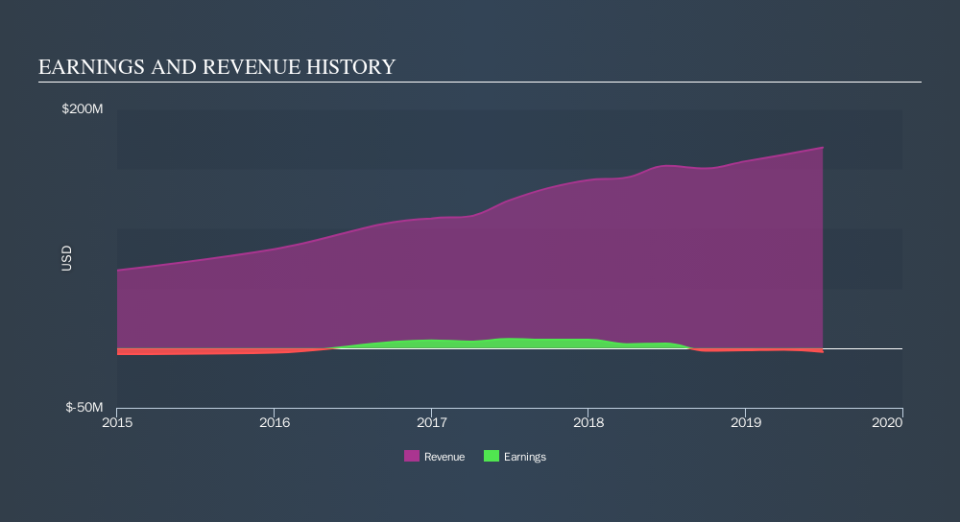

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on RYB Education's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 3.5% in the last year, RYB Education shareholders might be miffed that they lost 67%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 1.5% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like RYB Education better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance