Introducing Pure Global Cannabis (CVE:PURE), The Stock That Slid 59% In The Last Year

Pure Global Cannabis Inc. (CVE:PURE) shareholders will doubtless be very grateful to see the share price up 37% in the last quarter. But that doesn't change the fact that the returns over the last year have been disappointing. Like a receding glacier in a warming world, the share price has melted 59% in that period. So the bounce should be viewed in that context. Of course, it could be that the fall was overdone.

View our latest analysis for Pure Global Cannabis

With just CA$1,031,262 worth of revenue in twelve months, we don't think the market considers Pure Global Cannabis to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Pure Global Cannabis can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. It certainly is a dangerous place to invest, as Pure Global Cannabis investors might realise.

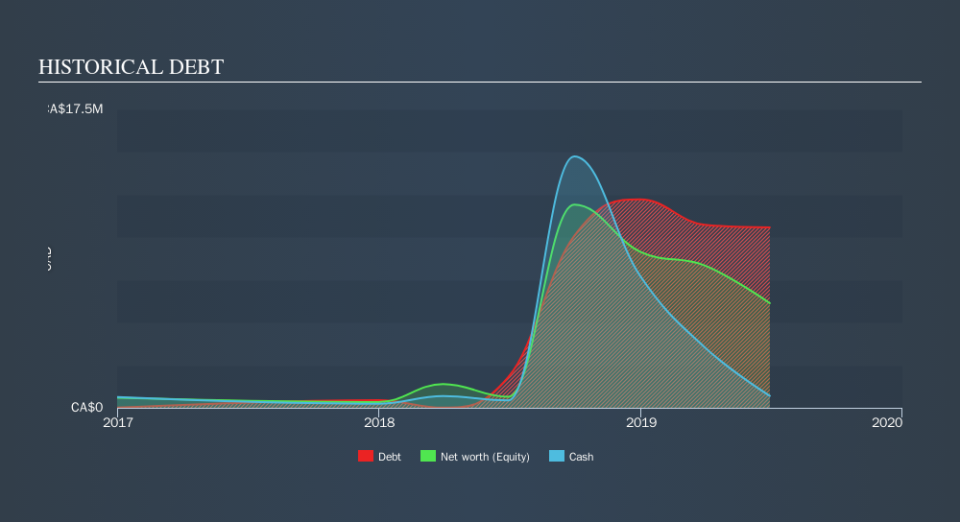

Our data indicates that Pure Global Cannabis had CA$12m more in total liabilities than it had cash, when it last reported in June 2019. That makes it extremely high risk, in our view. But since the share price has dived -59% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how Pure Global Cannabis's cash levels have changed over time (click to see the values). The image below shows how Pure Global Cannabis's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

Given that the market gained 4.4% in the last year, Pure Global Cannabis shareholders might be miffed that they lost 59%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 37% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). If you would like to research Pure Global Cannabis in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Pure Global Cannabis better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance