Introducing Kinross Gold (TSE:K), The Stock That Zoomed 103% In The Last Five Years

Kinross Gold Corporation (TSE:K) shareholders have seen the share price descend 15% over the month. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 103% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today.

See our latest analysis for Kinross Gold

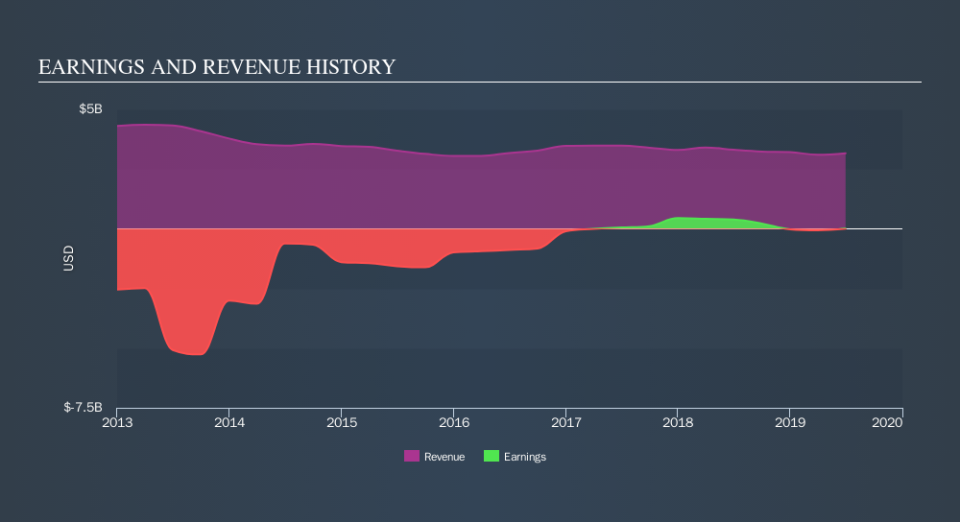

Given that Kinross Gold only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Kinross Gold saw its revenue shrink by 1.0% per year. On the other hand, the share price done the opposite, gaining 15%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Kinross Gold has grown profits over the years, but the future is more important for shareholders. This free interactive report on Kinross Gold's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Kinross Gold has rewarded shareholders with a total shareholder return of 67% in the last twelve months. That's better than the annualised return of 15% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before spending more time on Kinross Gold it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance