Intellia (NTLA) Beats on Q1 Earnings, Gives Pipeline Update

Intellia Therapeutics NTLA reported first-quarter 2023 loss of $1.17 per share, narrower than the Zacks Consensus Estimate and our model estimates of a loss of $1.41 and $1.53, respectively. In the year-ago quarter, Intellia incurred a loss of $1.96 per share.

The company’s total revenues, including collaboration revenues, came in at $13 million compared with $11 million in the year-ago period. Revenues marginally missed the Zacks Consensus Estimate by 1%. The figure, however, beat our model estimates of $11.2 million.

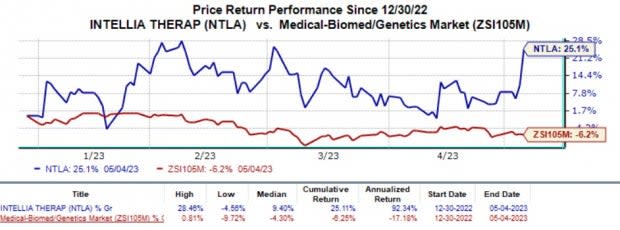

The stock has gained 10.4% in the year-to-date period against the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Quarter in Details

Research and development expenses were $97.1 million, down 27% from the year-ago quarter’s figure. The decrease was primarily due to the absence of $56.0 million in expenses related to the acquisition of Rewrite Therapeutics in the first quarter of 2022. This decline, however, was partially offset by an increase in expenses of $20 million due to the advancement of lead programs and personnel growth.

General and administrative expenses surged 22% year over year to $27.4 million due to an increase in employee-related expenses.

As of Mar 31, 2023, NTLA had cash, cash equivalents and marketable securities worth $1.2 billion compared with $1.3 billion as of Dec 31, 2022.

Pipeline Updates

Intellia is developing curative therapeutics using the CRISPR/Cas9 technology. It is evaluating its in-vivo genome-editing candidate NTLA-2001 for treatment of transthyretin (ATTR) amyloidosis. It is also evaluating NTLA-2002 in phase I/II study for the treatment of hereditary angioedema (HAE).

NTLA-2001 is part of Intellia’s co-development and co-promotion agreement with Regeneron Pharmaceuticals REGN. While NTLA is the lead party in the deal over NTLA-2001, REGN shares 25% of the development costs and commercial profits.

Intellia plans to submit an investigational new drug application to the FDA for NTLA-2001 to treat ATTR with cardiomyopathy (CM) by mid-2023. It also expects to initiate a global pivotal trial by the end of 2023, subject to regulatory feedback. NTLA and REGN also plan to present additional data from the ATTR-CM arm of the phase I study in 2023.

For hereditary ATTR amyloidosis with polyneuropathy (ATTRv-PN) arm, the dose-expansion portion of the phase I study has been completed. NTLA is actively preparing for a global pivotal study for the same. The company plans to present additional clinical data from the ATTRv-PN arm of the phase I study in 2023.

NTLA also announced dosing the first patient to evaluate NTLA-2002 in the phase II portion of its phase I/II study. The company intends to complete patient enrollment by the second half of 2023 and present data from the phase I portion by 2023-end.

Intellia Therapeutics, Inc. Price and EPS Surprise

Intellia Therapeutics, Inc. price-eps-surprise | Intellia Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Currently, Intellia has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same sector are Ocuphire Pharma OCUP and Allogene Therapeutics ALLO. While Ocuphire Pharma sports a Zacks Rank #1 (Strong Buy), Allogene Therapeutics carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss per share estimates for Ocuphire Pharma have narrowed from 29 cents to 24 cents for 2023 and from 86 cents to 81 cents for 2024, in the past 60 days. The company’s shares have surged 66% in the year-to-date period. Ocuphire’s earnings beat estimates in three of the last four quarters and missed the mark in one, the average surprise being 23.85%.

Loss per share estimates for Allogene have narrowed from $2.56 to $2.44 for 2023, in the past 60 days. Shares of ALLO have gained 2.5% in the year-to-date period. Allogene’s earnings beat estimates in each of the last four quarters, the average surprise being 8.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Intellia Therapeutics, Inc. (NTLA) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance