Insurance Stocks to Post Q1 Earnings on May 3: MET, ALL & More

Rising rates, product enhancements, changes in the business mix, strong retention and reinsurance agreements are likely to have benefited insurance industry stocks in the first quarter. Furthermore, accelerated digitalization, high-interest rate environment and organic business growth are expected to have boosted March-quarter results of companies like MetLife, Inc. MET, The Allstate Corporation ALL, Globe Life Inc. GL, Selective Insurance Group, Inc. SIGI and Radian Group Inc. RDN, which are set to announce quarterly numbers on May 3. Yet, rising expenses and an active catastrophe environment are likely to have been spoilsports.

The insurance space belongs to the Finance sector (one of the 16 broad Zacks sectors within the Zacks Industry classification), overall earnings of which are projected to jump 5.7% from the year-ago quarter’s reported figure. Revenues are expected to increase 8.1%, as indicated by our latest Earnings Preview. This shows drastic changes from the previous quarter, thanks to the improving economy. For insurance players, rising earned premiums are likely to have contributed to the upside, partially offset by higher expenses stemming from inflationary pressures.

Let’s delve deeper and look at the key factors that are expected to have impacted the insurance stocks during the quarter under review.

Factors Setting the Tone for Insurance Stocks’ Q1 Results

Insurance players, having property and casualty line of business exposure, are likely to have taken a hit from winter storms-led catastrophe losses. Per Aon’s Impact Forecasting division, global insured catastrophe losses in the first quarter are estimated at $15 billion, with 58% contributed by disasters in the United States. Favorable reserve development is expected to have enabled insurers to counter catastrophe losses and shielded their underwriting results.

While an active catastrophe environment takes its toll, it usually accelerates policy renewal rates and calls forth insurers to administer rate hikes for seamless claim payments. Insurance pricing in the United States increased 4% in the March quarter, per the Marsh Global Insurance Market Index. Improved pricing, client retention and exposure growth are anticipated to have enabled the industry players to generate higher premiums in the first quarter. Moreover, diversified portfolios minimizing concentration risks are expected to have aided their profit growth.

Throughout the first quarter, product diversification and redesigning are likely to have positioned insurers to address rising demand, fueling revenue growth in the quarter. Moreover, growing awareness following the onset of the COVID-19 pandemic is expected to have continued to support businesses.

The rising frequency of travel across the world following the receding pandemic effects is likely to have boosted auto premiums. However, the positives are expected to have been partially offset by rising expenses for auto parts, stemming from inflationary pressures. Growing economic activities are anticipated to have aided the commercial insurance and group insurance businesses in the first quarter. Companies with rate-sensitive products and investments are expected to have benefited from the high interest rate environment.

Accelerated digitalization and the emergence of insurtech are expected to have improved operating efficiency for insurance companies. Technologies like artificial intelligence, advanced analytics, cloud computing, blockchain, telematics and robotic process automation aid seamless operations and lowers costs. This is likely to have boosted the margins of the insurance players in the first quarter.

Insurance Providers Reporting on May 3

Against the backdrop discussed above, let’s find out how the following five companies are placed ahead of their March-quarter earnings release tomorrow.

Our proprietary model indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

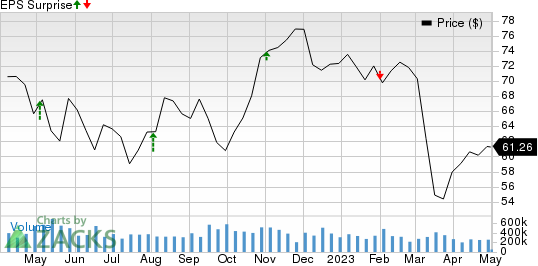

MetLife: The Zacks Consensus Estimate for MetLife’s premiums suggests a fall of 3.8% from the prior-year quarter, whereas our estimate indicates a 3.7% decline. However, the consensus mark for adjusted earnings in Latin America indicates a 25.2% jump from the year-ago period’s actuals.

The Zacks Consensus Estimate for MET’s U.S. business adjusted earnings suggests a jump of 20.2% from the prior-year quarter’s reading. Also, the consensus mark for net investment income indicates a 6.1% year-over-year increase from the year-ago period. These are likely to have partially offset the negatives in the quarter under review.

The Zacks Consensus Estimate for the first-quarter earnings and revenues stands at $1.85 per share and $16.9 billion, respectively, indicating a decline of 11.1% and 4.7% from the corresponding year-ago quarter’s actuals. MetLife’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and missed once, the average surprise being 12.1%.

Our proven model predicts a likely earnings beat for MetLife this time around. This is because the stock has an Earnings ESP of +0.04% and a Zacks Rank #3.

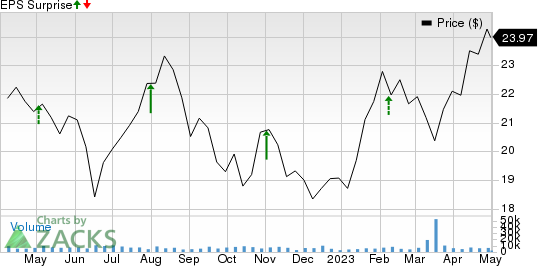

MetLife, Inc. Price and EPS Surprise

MetLife, Inc. price-eps-surprise | MetLife, Inc. Quote

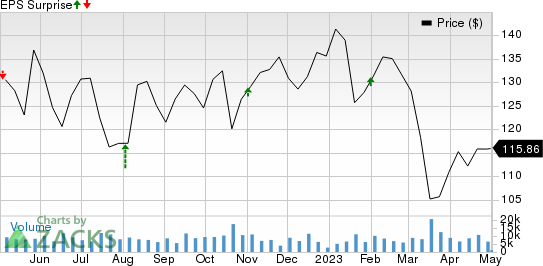

The Allstate Corporation: This leading property-casualty insurer’s first-quarter revenues are likely to have been supported by better premiums in the Property-Liability segment. The consensus mark for net premiums earned in the Property-Liability segment indicates an improvement of 9.6% from the prior-year quarter’s reported figure. Also, the Zacks Consensus Estimate for net investment income suggests 0.7% year-over-year growth on the back of growing market-based investment income.

On the flip side, Allstate’s Q1 earnings are expected to have taken a hit from pre-tax catastrophe losses of $1.7 billion in the first quarter. Elevated property and casualty insurance claims and claims expenses are expected to have affected ALL’s profits in the first quarter.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top line is pegged at a loss of $1.94 per share and $12.8 billion, respectively, indicating an earnings decline of 175.2% but a revenue increase of 1.8% from the corresponding year-ago quarter’s readings. ALL’s bottom line beat the Zacks Consensus Estimate in three of the last four quarters, missing the mark once, the average surprise being 8.4%.

Allstate has an Earnings ESP of 0.00% and a Zacks Rank of 3. (Read more: Factors Likely to Set the Tone for Allstate's Q1 Earnings)

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

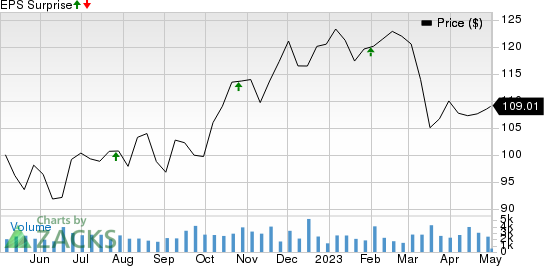

Globe Life: The Zacks Consensus Estimate for GL’s premiums indicates an upside of 3.1% from the year-ago quarter’s level. The consensus estimate for net investment income indicates 5.1% year-over-year growth. Also, the consensus mark for life insurance underwriting income indicates a 59.2% surge in the quarter under review from the year-ago period’s finals.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top line stands at $2.47 per share and $1.4 billion, respectively. The consensus estimate for earnings indicates an increase of 45.3% while the same for revenues suggests a rise of 3.7% from the respective year-earlier period’s readings. As far as earnings surprises are concerned, GL’s bottom line beat the Zacks Consensus Estimate in three of the last four quarters and missed once, the average surprise being 1.2%.

Things are looking up for Globe Life this time around as well because it has an Earnings ESP of +0.47% and a Zacks Rank #3.

Globe Life Inc. Price and EPS Surprise

Globe Life Inc. price-eps-surprise | Globe Life Inc. Quote

Selective Insurance Group: New business generation and exposure growth are likely to have aided Selective Insurance’s first-quarter performance. The Zacks Consensus Estimate for net premiums earned suggests 12.5% year-over-year growth. Also, the consensus mark for net investment income earned predicts a 15.2% increase from the year-ago period. However, the consensus mark for the underwriting expense ratio is pegged at 34.07%, estimating a 197 basis points increase.

The Zacks Consensus Estimate for first-quarter earnings and revenues stands at $1.57 per share and $999.8 million, respectively, indicating an earnings increase of 11.4% and a revenue rise of 12.8% from the respective year-earlier period’s readings. As far as earnings surprises are concerned, SIGI’s bottom line beat the Zacks Consensus Estimate in one of the last four quarters, met once and missed on the other two occasions, the average negative surprise being 4.7%.

Things are not looking up for Selective Insurance this time around as it has an Earnings ESP of -3.19% and is a Zacks #2 Ranked stock.

Selective Insurance Group, Inc. Price and EPS Surprise

Selective Insurance Group, Inc. price-eps-surprise | Selective Insurance Group, Inc. Quote

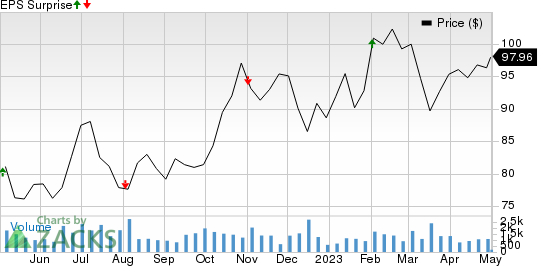

Radian Group: Higher net investment income and growth in monthly premium policy insurance in force are likely to aid Radian Group’s first-quarter results. Higher mortgage interest rates are expected to have helped RDN’s persistency. Lower claim payments are also likely to have boosted margins in the first quarter. However, the positives are expected to have been offset by lower premiums, rising expenses stemming from inflationary pressures and increased operating costs.

The Zacks Consensus Estimate for the first-quarter earnings and revenues stands at 76 cents per share and $181.3 million, respectively, indicating an earnings decline of 35% and a revenue fall of 43.8% from the respective year-earlier period’s readings. RDN’s bottom line beat the Zacks Consensus Estimate in all the last four quarters, the average surprise being 38.6%.

Radian Group has an Earnings ESP of 0.00% and is a Zacks #3 Ranked player.

Radian Group Inc. Price and EPS Surprise

Radian Group Inc. price-eps-surprise | Radian Group Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Selective Insurance Group, Inc. (SIGI) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance