Institutions Own Fewer Tesla, Inc. Shares (NASDAQ:TSLA) Than You Might Think

This article first appeared on Simply Wall St News.

It is hard to compete against Tesla, Inc. (NASDAQ: TSLA), especially when it comes to volatility. After setting a new all-time high upon the S&P500 inclusion, the stock lost an incredible 40%.

However, the recent price action has been very encouraging for bulls. As the stock marches to new highs, we will look at the current ownership structure in this article.

See our latest analysis for Tesla.

Latest Developments

Cathie Wood, CEO of Ark Invest, explained the move to sell 180,000 TSLA shares as a cash-raising measure to boost the stake in UiPath (NYSE: PATH). Wood pointed out that TSLA remains the largest holding in her portfolio, confirming the bullish stance on the stock.

Meanwhile, the company just obtained a patent for laser beam windshield wiper technology. From the current standpoint, it is hard to understand why anyone would potentially point a laser toward the driver. Still, a proper application of this technology is yet to be understood. In addition, Tesla also possesses a patent for electromagnetic wipers.

The problems with automated driving are persistent as the latest Model 3 fatal crash in Florida prompted the investigation by the National Transportation Safety Board (NTSB). The agency officials have been following the application of autonomous driving technologies, already investigating 33 crashes involving Tesla vehicles with partially automated driver-assist systems.

On a more positive note, Wedbush Securities issued a positive note, claiming that Tesla can get to 900k deliveries in 2021 and 1.3m in 2022. The data below shows that after the first half of 2021, the company still leads the global plug-in EV market.

Wedbush has Tesla as “Outperform,” with a price target of US$1,000, which would be a new all-time high.

An Ownership Overview

With a market capitalization of US$752b, Tesla is relatively large. We'd expect to see institutional investors on the register. Companies of this size are usually well known to retail investors, too.

Our analysis of the company's ownership below shows that institutions own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Tesla.

What Does The Institutional Ownership Tell Us About Tesla?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

We can see that Tesla does have institutional investors, but insiders and the general public still outnumber them.

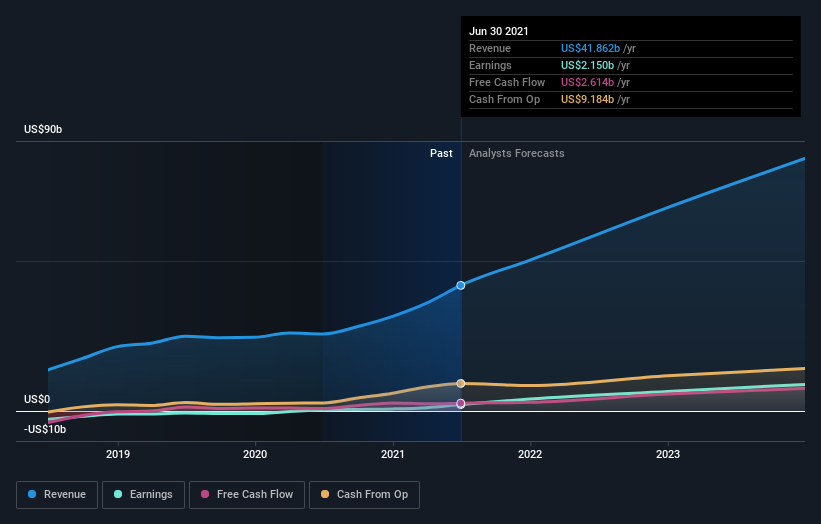

It's, therefore, worth looking at Tesla's earnings history below. Of course, the future is what matters.

Looking at our data, we can see that the largest shareholder is CEO Elon Musk, with 17% of shares outstanding. Meanwhile, the second and third largest shareholders hold 6.0% and 5.1% of the shares outstanding, respectively.

A closer look at our ownership figures suggests that the top 21 shareholders have a combined ownership of 50%, implying that no single shareholder has a majority.

While studying institutional ownership data for a company makes sense, it also makes sense to research analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be helpful to find out their aggregate view on the future.

Insider Ownership Of Tesla

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management runs the business, but the CEO will answer the board, even if they are a member.

We generally consider insider ownership to be a good thing. However, it makes it more difficult for other shareholders to hold the board accountable for decisions on some occasions.

It seems insiders own a significant proportion of Tesla, Inc. It has a market capitalization of just US$752b, and insiders have US$143b worth of shares in their names. That's quite significant. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public, with a 37% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It is interesting to look at who exactly owns a company, but to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Tesla that you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12 months ending on the previous date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance