Imagine Owning Snipp Interactive (CVE:SPN) And Trying To Stomach The 78% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So consider, for a moment, the misfortune of Snipp Interactive Inc. (CVE:SPN) investors who have held the stock for three years as it declined a whopping 78%. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 43% in the last year. The silver lining is that the stock is up 8.3% in about a week.

View our latest analysis for Snipp Interactive

Given that Snipp Interactive didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

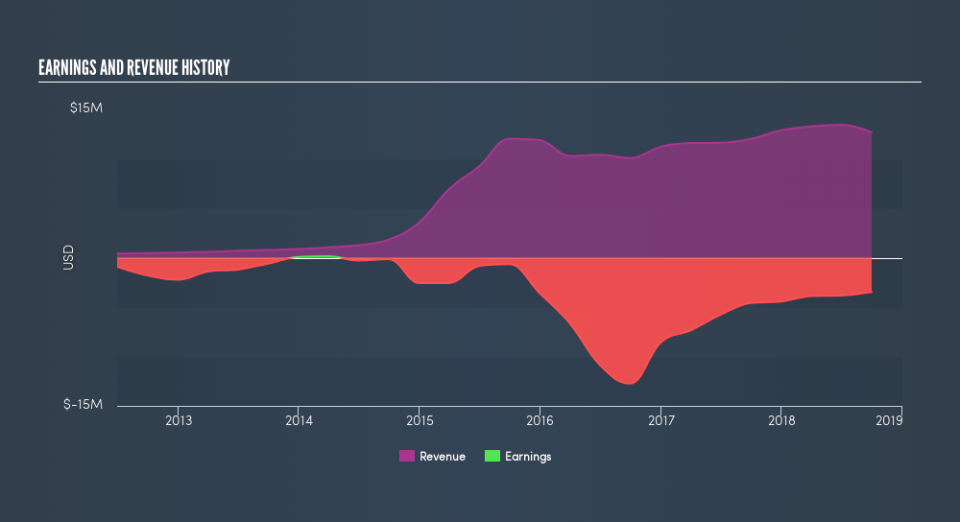

In the last three years, Snipp Interactive saw its revenue grow by 6.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 40%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Before considering a purchase, take a look at the losses the company is racking up.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

If you are thinking of buying or selling Snipp Interactive stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 6.6% in the last year, Snipp Interactive shareholders lost 43%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 15% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Snipp Interactive in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Snipp Interactive may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance