Imagine Owning GTT Communications (NYSE:GTT) While The Price Tanked 54%

GTT Communications, Inc. (NYSE:GTT) shareholders will doubtless be very grateful to see the share price up 61% in the last quarter. But that's small comfort given the dismal price performance over the last year. During that time the share price has sank like a stone, descending 54%. It's not that amazing to see a bounce after a drop like that. It may be that the fall was an overreaction.

See our latest analysis for GTT Communications

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the GTT Communications share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. In fact, we can see extraordinary items impacting earnings in the last twelve months.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

GTT Communications managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

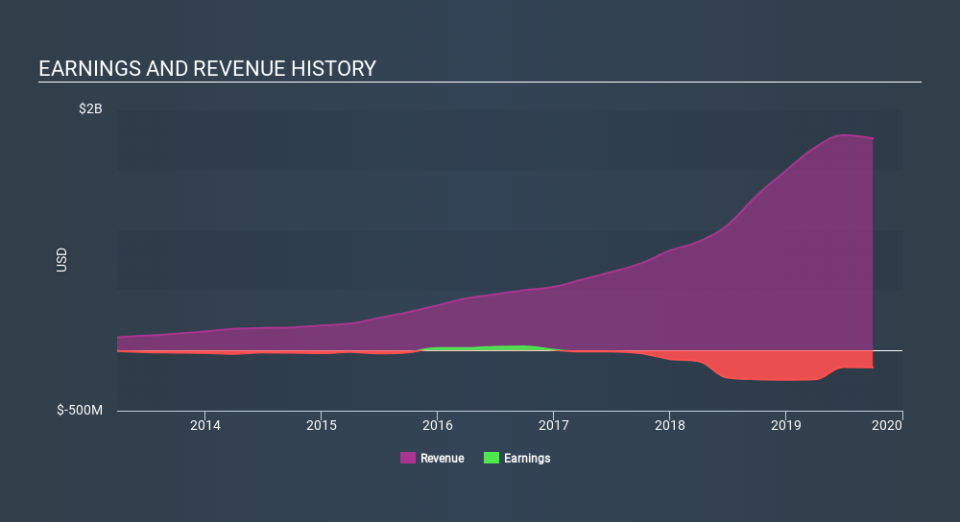

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for GTT Communications in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 6.5% in the last year, GTT Communications shareholders lost 54%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for GTT Communications that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance