Imagine Owning Globalive Technology (CVE:LIVE) And Trying To Stomach The 91% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. We wouldn't blame Globalive Technology Inc. (CVE:LIVE) shareholders if they were still in shock after the stock dropped like a lead balloon, down 91% in just one year. That'd be a striking reminder about the importance of diversification. Globalive Technology hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 47% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Globalive Technology

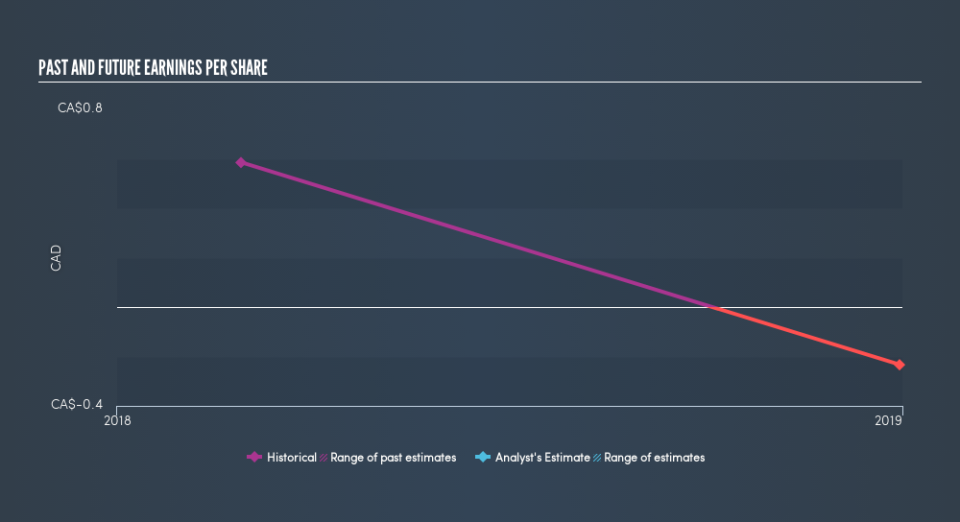

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Globalive Technology saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While Globalive Technology shareholders are down 91% for the year, the market itself is up 1.0%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 47%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you would like to research Globalive Technology in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Globalive Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance