Can You Imagine How Elated BATM Advanced Communications' (LON:BVC) Shareholders Feel About Its 488% Share Price Gain?

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the BATM Advanced Communications Ltd. (LON:BVC) share price. It's 488% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve.

View our latest analysis for BATM Advanced Communications

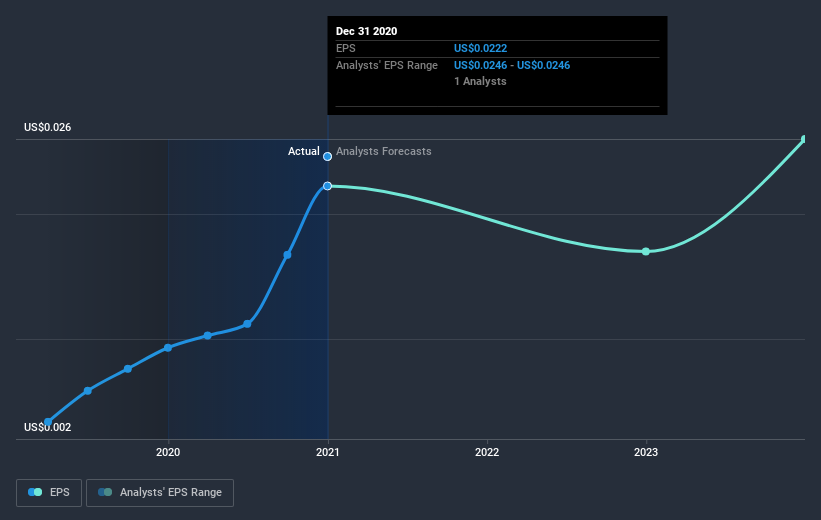

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, BATM Advanced Communications moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the BATM Advanced Communications share price is up 246% in the last three years. In the same period, EPS is up 238% per year. This EPS growth is higher than the 51% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. Having said that, the market is still optimistic, given the P/E ratio of 59.02.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how BATM Advanced Communications has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at BATM Advanced Communications' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that BATM Advanced Communications shareholders have received a total shareholder return of 122% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 43% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - BATM Advanced Communications has 1 warning sign we think you should be aware of.

Of course BATM Advanced Communications may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance