Can You Imagine How Chuffed ACADIA Pharmaceuticals's (NASDAQ:ACAD) Shareholders Feel About Its 215% Share Price Gain?

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) share price has soared 215% return in just a single year. Also pleasing for shareholders was the 11% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 7.7% in 90 days). It is also impressive that the stock is up 52% over three years, adding to the sense that it is a real winner.

See our latest analysis for ACADIA Pharmaceuticals

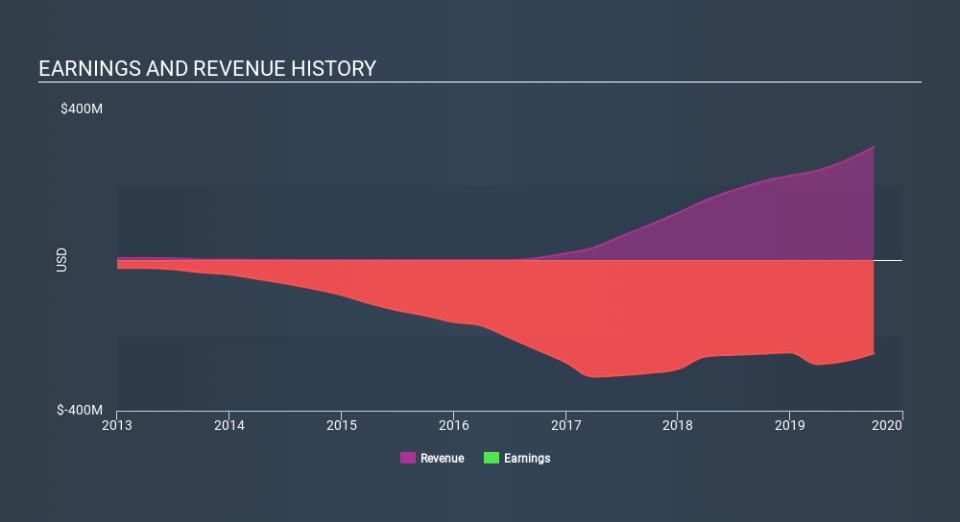

Given that ACADIA Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, ACADIA Pharmaceuticals's revenue grew by 45%. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 215% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

ACADIA Pharmaceuticals is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's nice to see that ACADIA Pharmaceuticals shareholders have received a total shareholder return of 215% over the last year. That gain is better than the annual TSR over five years, which is 7.3%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. If you would like to research ACADIA Pharmaceuticals in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance