IBM, Airtel Team Up for Secure Edge Cloud Services in India

International Business Machines Corporation IBM recently inked an agreement with Bharti Airtel for an undisclosed amount to deploy an edge computing platform in India. This is likely to extend the secured cloud services for business enterprises while improving their performance through reduced latency and higher data security features.

With more than 358 million subscribers, Airtel is a leading telecommunication services provider in the subcontinent. Its edge computing platform is likely to encompass 120 network data centers across 20 cities, offering innovative solutions securely at the edge to large enterprises across multiple industries, including manufacturing and automotive.

Leveraging a hybrid environment based on IBM Cloud Satellite and Red Hat OpenShift, the platform is widely expected to address the critical business needs of large enterprises with greater efficiency. This, in turn, is likely to enable the firms to seamlessly process a huge quantum of data on a real-time basis by harnessing Airtel's 5G connectivity and secured edge computing capabilities from IBM for superior performance.

IBM is poised to benefit from strong demand for hybrid cloud and AI, driving growth in Software and Consulting businesses. The company’s growth is expected to be driven primarily by analytics, cloud computing and security in the long haul. A combination of a better business mix, improving operating leverage through productivity gains and increased investment in growth opportunities will likely drive profitability.

IBM's research and development (R&D) initiatives set it apart from its peers. On an annual basis, the company invests around 7-8% on R&D for reaping high-growth and high-value opportunities. The acquisition of Red Hat has further bolstered the Open Hybrid Architecture Initiative of the company. More than 3,800 clients are utilizing Red Hat and IBM’s hybrid cloud platform. We remain optimistic regarding the improving utility of hybrid cloud services based on the architecture built by IBM and Red Hat.

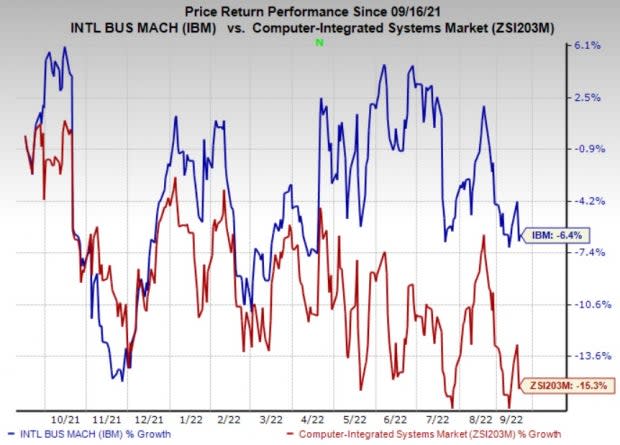

IBM has lost 6.4% over the past year compared with the industry’s decline of 15.3%.

Image Source: Zacks Investment Research

We are impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TESSCO Technologies Incorporated TESS, carrying a Zacks Rank #2, delivered an earnings surprise of 61.9%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 31% since September 2021.

TESSCO offers products to the industry’s top manufacturers in mobile communications, Wi-Fi, wireless backhaul and related products. With more than three decades of experience, it delivers complete end-to-end solutions to the wireless industry.

Spirent Communications plc SPMYY carries a Zacks Rank #2. Earnings estimates for the current year for the stock have moved up 10.8% since September 2021, while that for the next year is up 11.8%.

Founded in 1936 and headquartered in Crawley, the United Kingdom, Spirent offers a comprehensive, end-to-end solution that validates forwarding performance, latency and functional capabilities in an integrated approach that reduces the cost of ownership. It is a leading provider of Ethernet validation solutions in the market.

Harmonic Inc. HLIT, carrying a Zacks Rank #2, delivered an earnings surprise of 79.3%, on average, in the trailing four quarters. Earnings estimates for Harmonic for the current year have moved up 12.9% since February 2022.

Harmonic provides video delivery software, products, system solutions and services worldwide. With more than three decades of experience, it has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers' homes and mobile devices.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

TESSCO Technologies Incorporated (TESS) : Free Stock Analysis Report

Spirent Communications PLC (SPMYY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance