Huntsman's (HUN) Q3 Earnings In Line, Sales Miss Estimates

Huntsman Corporation HUN recorded profits of $115 million or 50 cents per share in the third quarter of 2022, down from $225 million or 94 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share fell to 71 cents in the reported quarter from $1.02 in the year-ago quarter. The bottom line matched the Zacks Consensus Estimate.

Revenues were $2,011 million, down around 4% year over year. The top line missed the Zacks Consensus Estimate of $2,038 million.

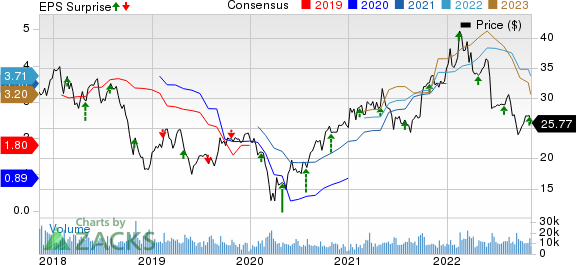

Huntsman Corporation Price, Consensus and EPS Surprise

Huntsman Corporation price-consensus-eps-surprise-chart | Huntsman Corporation Quote

Segment Highlights

Polyurethanes: Revenues from the segment fell 10% year over year to $1,257 million in the reported quarter, hurt by reduced sales volumes and unfavorable currency translation, partly offset by higher MDI (methylene diphenyl diisocyanate) average selling prices. Volumes fell mainly due to lower demand, especially in European and construction markets.

Performance Products: Revenues rose 9% to $434 million courtesy of higher average selling prices led by commercial excellence programs and higher raw material costs. Volumes fell due to a shift in business strategy and weaker demand.

Advanced Materials: Revenues from the unit went up 8% to $328 million on higher average selling prices, partly offset by lower sales volumes. Average selling prices rose in response to higher raw material, energy and logistics costs, and improved mix.

Financials

Huntsman had total cash of $515 million at the end of the quarter, increasing around 2% year over year. Long-term debt amounted to $1,476 million, down roughly 6% from the year-ago quarter.

Net cash provided by operating activities from continuing operations was $285 million for the reported quarter. Free cash flow from continuing operations was $228 million compared with $106 million in year-ago quarter.

The company repurchased around 8.9 million shares for roughly $251 million in the reported quarter.

Outlook

Huntsman noted that the global business environment has become increasingly difficult with slowing growth across many of its end markets. Record high energy prices and lower demand is pressuring its European facilities and margins.

The company has significantly curtailed production rates in response to slower European demand and higher costs. It is committed to further realign its cost structure above and beyond its earlier announced cost optimization programs with additional restructuring in Europe to address the longer-term issues in Europe, HUN noted. The company has identified an incremental $40 million of costs as it realigns its business services and production facilities and expects this business restructuring to complete by the end of 2023.

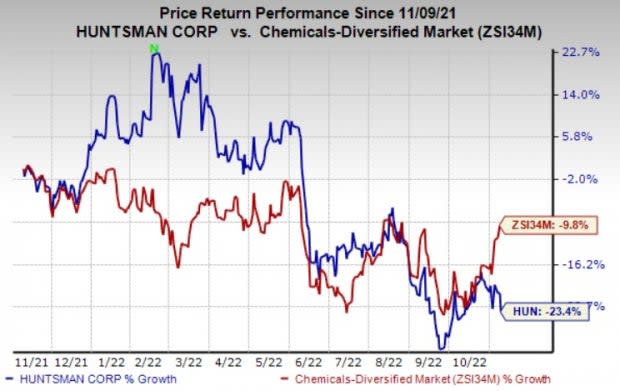

Price Performance

Shares of Huntsman have declined 23.4% in the past year against a 9.8% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Huntsman currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Commercial Metals Company CMC and Reliance Steel & Aluminum Co. RS.

Albemarle, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 420.3% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 5.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 9% in a year.

Commercial Metals currently carries a Zacks Rank #2. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 3.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 32% in a year.

Reliance Steel, currently carrying a Zacks Rank #2, has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 21% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Huntsman Corporation (HUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance