HPE Makes Investment in TruEra Through Pathfinder Program

Hewlett Packard Enterprise HPE invested in California-based artificial-intelligence ("AI") quality leader, TruEra, through its Pathfinder program.

Through the Pathfinder program, HPE invests in leading startup firms to generate solutions by integrating technologies from portfolio companies with HPE products and developing joint go-to-market programs. As the multi-million dollar investor and partner to TruEra, HPE will jointly design comprehensive solutions for its enterprise clients with its High-Performance Computing Solution.

Founded in 2019, TruEra provides AI Quality solutions to explain, debug, and monitor machine learning models, enabling higher quality and quick deployment. From Jun 28-30, the company will present its software solutions at HPE Discover 2022 conference. TruEra will be available at the Pathfinder booth #DEMO607.

HPE is witnessing weaker server demand due to macroeconomic uncertainties and the ongoing shift to cloud computing. Supply-chain constraints are likely to hurt its growth prospects in the near term. However, the company’s efforts to shift focus to higher-margin offerings like Intelligent Edge and Aruba Central Hyperconverged Infrastructure (“HCI”) are aiding its bottom-line performance. The company’s multi-billion-dollar investment plan to expand networking capabilities will help diversify business and boost margins over the long run.

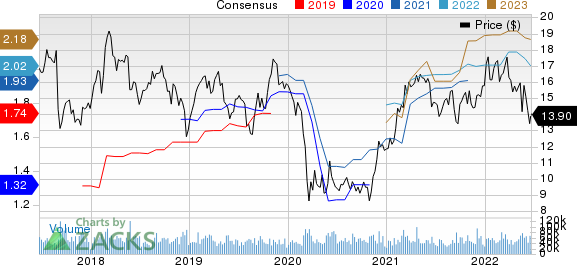

Hewlett Packard Enterprise Company Price and Consensus

Hewlett Packard Enterprise Company price-consensus-chart | Hewlett Packard Enterprise Company Quote

Further, HPE’s edge-to-cloud platform, Greenlake, continues to win back-to-back deals. Recently, Iliane, a France-based cloud services provider, selected GreenLake to enhance the deployment of cloud-based solutions built for regional accounts.

Prior to that, in March, Hewlett Packard expanded its GreenLake edge to a cloud platform to include support for Microsoft MSFT Azure Stack HCI. The new integrated system comprises scalable hyper-converged infrastructure, software and services, delivered in enterprise customers’ data centers or colocation facilities.

Microsoft's integrated cloud-native solution delivered as a service from HPE’s GreenLake platform not only ensures cost efficiency but also accelerates digital transformation among enterprise clients.

In the same month, HPE entered an agreement with the Japanese payment brand JCB Co. Ltd., wherein the latter selected the HPE GreenLake platform. Through this move, JCB intended to enhance its MyJCB platform while improving customer engagement with new personalized customer services.

In January, leading multi-brand tech solutions provider CDW Corporation CDW selected the platform to enhance its core UK cloud suite of products called ServiceWorks.

With HPE GreenLake, CDW is able to flexibly check the alignment of cost and revenues, thereby improving its predictability, visibility and control over further investments in service solutions.

Zacks Rank

Hewlett Packard currently carries a Zacks Rank #4 (Sell). Microsoft and CDW carry a Zacks Rank #3 (Hold) each. Shares of HPE, MSFT and CDW have plunged 4.9%, 4.5% and 6.6%, respectively, in the past year.

Stock to Consider

A better-ranked stock from the broader Computer and Technology sector is Axcelis Technologies ACLS, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axcelis’ second-quarter fiscal 2022 earnings has been revised 3 cents northward to 99 cents per share over the past 60 days. For 2022, earnings estimates have moved 10.3% north to $4.40 per share in the past 60 days.

Axcelis' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 23.5%. Shares of ACLS have surged 39.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance