How US importers are avoiding Trump's tariffs

With no reprieve in sight amid the tit-for-tat tariffs between the U.S. and China and the threat of more, U.S. companies have been tweaking their supply chains to avoid higher prices.

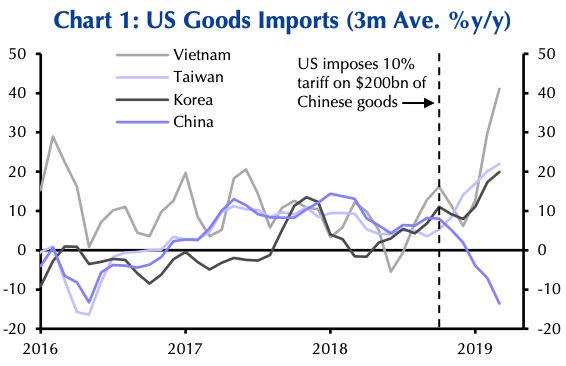

Imports from China have fallen sharply since last October after the U.S. imposed 10% tariffs on $200 billion of Chinese goods, according to a report by Capital Economics. And China’s loss has become South Korea, Taiwan, and Vietnam’s gain. Shipments from those countries, particularly Vietnam, have boomed as U.S. importers switch suppliers out of China. Imports from these other Asian countries have increased by $30 billion at an annualized pace, while imports from China have declined by $75 billion.

Over the past year, Vietnam has been the biggest beneficiary of U.S. import substitution. The additional U.S. imports have accounted for 7.9% of the country’s GDP, according to Nomura.

Contrary to Trump’s claims that U.S. coffers are being filled with billions of dollars from his tariff policy, federal customs duties (tariff money coming in to the federal government) has actually dropped. At its peak, U.S. federal customs duties brought in $79.5 billion in January; that has since fallen to $62.8 billion in April as companies are importing less from China.

Given the substitutions in suppliers by U.S. importers to avoid tariffs, the impact to GDP may not be as bad as previously estimated, Capital Economics says. A more modest rise in the cost of goods could lead to GDP falling below 0.5% rather than 0.7% as previously projected.

Tariff on Mexican imports

The trade war with China has led to an increase in U.S. imports from Mexico in motor vehicle parts over the past year, according to Nomura. The additional U.S. imports account for 0.8% of the country’s GDP.

While companies may have once considered Mexico a safe harbor for production given the progress of the U.S. Mexico Canada Agreement negotiations, that’s no longer the case given the threat of 5% tariffs on Mexico starting June 10.

If Trump does impose 5% tariffs on Mexico every month, Capital Economics forecasts it would cause chaos in the tightly integrated supply chains of the car production industry because there’s little opportunity in the short term to make adjustments. The cost to companies would be magnified because tariffs would be imposed every time car parts crossed the border.

Follow Sibile Marcellus on @SibileTV

More from Sibile:

New Trump tariffs would affect nearly 70% of consumer goods: Citi

‘Dysfunctional’ Washington is top concern for high-net-worth investors: UBS

Oprah’s longtime partner Stedman Graham on why she’s not running in 2020

Underemployment for recent grads worse today than in early 2000s

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance