How the federal government can make home ownership more affordable for Canadians

Considering the high price of admission, it’s probably no surprise that a growing number of Canadians are finding themselves priced out of the housing market.

Those that can afford to get their foot in the door often cope with being house rich and money poor. A new national survey by Zoocasa shows 82 per cent Canadians polled say affordability is a major issue that has negatively impacted the country. The survey included renters as well as homeowners.

There have been rumours that Finance Minister Bill Morneau will announce measures in the upcoming federal budget.

“The pressure has been mounting on the federal government in recent years to take action to improve affordability; all eyes are on whether new measures will be announced in the upcoming budget to be released on March 19,” said Penelope Graham, Managing Editor at Zoocasa, in the report

“As well, new promises to improve Canadians’ ability to buy real estate will be a key platform for all parties as the next federal election approaches in October.”

But 55 per cent of respondents say the situation can’t be fixed with government policy measures alone. Only 21 per cent feel confident that the government can improve housing affordability within the next 5 years.

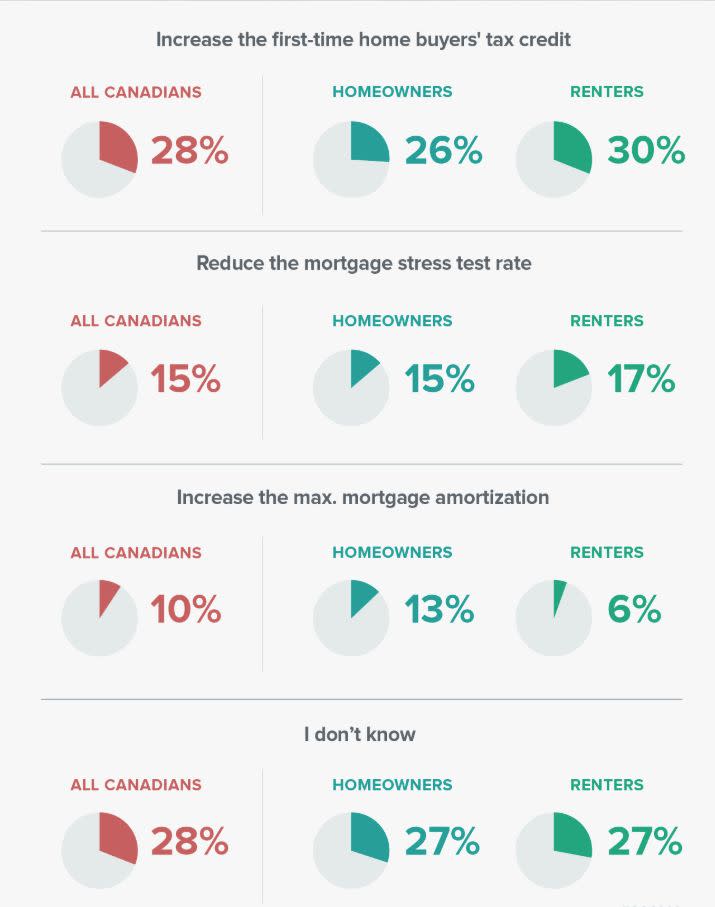

Reducing or eliminating the mortgage stress test is one option. Half said it reduced affordability but only 15 per cent said reducing it would be the most helpful measure.

Even fewer people think longer mortgages would do the trick. Only 10 per cent said a 30 year mortgage for first-time buyers with less than a 20 per cent downpayment is the answer.

More cash in their pocket was suggested as the top tool to increase affordability. More than a quarter (28 per cent) say increasing the first-time home buyers tax credit is the way to go. It’s currently $750.

The same percentage of Canadians polled say they don’t know what the best path forward is.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance