How I booked my honeymoon to Italy using the Chase Sapphire Reserve

By Mandi Woodruff, Magnify Money

I’ve never had much patience for rewards credit cards before. It always seemed counterintuitive to spend thousands of dollars, earn a few bonus points, and then strap myself to a high-fee, high-interest debt trap in the process.

That all changed when the Chase Sapphire Reserve card hit the market last fall. Chase dangled a carrot so juicy that I (and reportedly hundreds of thousands of others) couldn’t look away: a 100,000-point bonus offer good for $1,500 in travel, plus some of the best travel reward benefits of any major credit card to date. (Heads up: That sign-up offer will be cut in half on Jan. 12.)

The catch: I had to spend $4,000 in under three months and be cool with a stomach-turning $450 annual fee.

For me, the math worked out. With the other fringe benefits offered by the Reserve card (including a $300 annual travel credit) the net annual fee can actually be less than $150 a year.

So, I set myself a lofty goal: I would use my Chase Reserve bonus miles to finance a two-week honeymoon abroad. I’m no mile runner and I’ve never booked an international trip using credit card points before, so this was a daunting challenge.

In the end, my fiance and I managed to book roundtrip flights from New York City to two cities in Italy and one city in Spain for a grand total of $246.32.

Here’s how I did it:

My strategy:

I had excellent credit to start with.

The underwriting process for this card is no joke. You will likely need to have an excellent credit score (think 680 and above) to qualify. Also, beware the 5/24 rule.

I never carried a balance.

The only way I would make this sign-up bonus worthwhile is if I was hypervigilant and never kept a balance on my card. No balance means no interest charges, and no eating into my rewards benefits. This is important to know because the Chase Sapphire Reserve card does not come with the cushion of a 0% introductory APR for new customers. Even with my 750+ credit score, I was still stuck with a 16% APR.

I made the card my official wedding and travel card.

I am actively planning a spring wedding, which means I’m basically bleeding cash all the time. It took less than a month to put $4,000 on the card and nab the 100,000 point sign-up bonus. I immediately paid off all expenses with savings from my wedding fund. From there, I used the card mostly for travel and dining because I earned 3 points for each dollar spent. With this strategy, I had well over 120,000 points when it was time to book our trip.

We doubled our points by opening a second Chase Sapphire Reserve card.

Once I qualified for the sign-up bonus and paid the card off, I asked my fiance to sign up for the same card. For the next few months, we shifted all of our spending to his Chase Sapphire Reserve card to meet the $4,000 spending requirement. Voila — another 100,000 points in the bank!

What I learned is that earning those points was a lot easier than turning those points into the international vacation of my dreams. But now that I’ve done the hard work, I’m sharing everything I learned with you.

I maximized my points by redeeming them for travel, rather than cash back.

It may be tempting to use your Chase Ultimate Rewards points for cash back. At the moment, every one Chase point is worth one cent when it’s redeemed for cash. With 200,000 points combined, we could have redeemed those points for $2,000 (as a statement credit or a cash deposit into our checking account). But Chase Ultimate Rewards points are worth 1.5 cents when redeemed for travel (you can book travel directly through the rewards portal, or book with partner airlines). By redeeming for travel, we could potentially increase our points’ cash value by a whopping 50% — from $2,000 to $3,000. In the end, we nearly tripled our points value, and I’ll explain how later.

Combining points with a partner/spouse

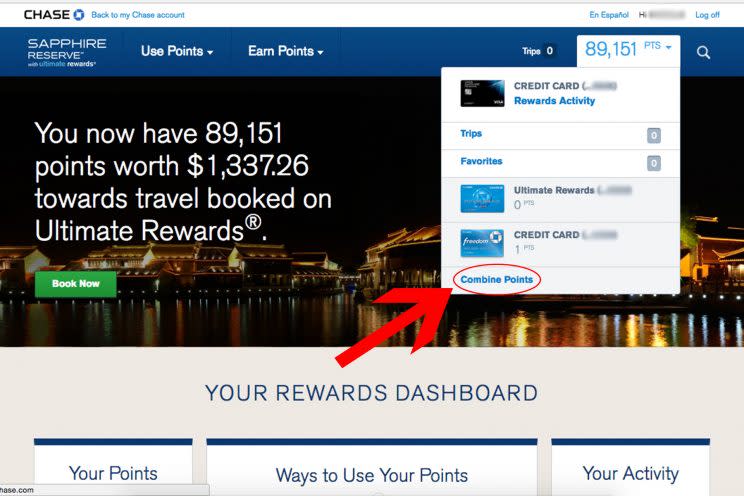

Next challenge: Combining all of our Chase Ultimate Rewards points

Points earned on all Chase credit cards are called “Chase Ultimate Rewards points.” You can access your points by going to the Ultimate Rewards site. Because we had separate accounts, we had to take a few steps to combine our loot.

-First, log into your Chase Ultimate Rewards account.

-On the upper right-hand of the screen, where there is a tally of your rewards points, hover with your mouse.

-A drop-down menu will appear.

-Select the tab called “Combine Points.”

-Select “Add Household Member.”

You’re allowed to share points with up to one household member, which is convenient if you’re sharing points with a partner or spouse. All you need is their credit card number and name. I returned the favor and added my fiance as a household member on my account. Now, we can transfer points to one another anytime.

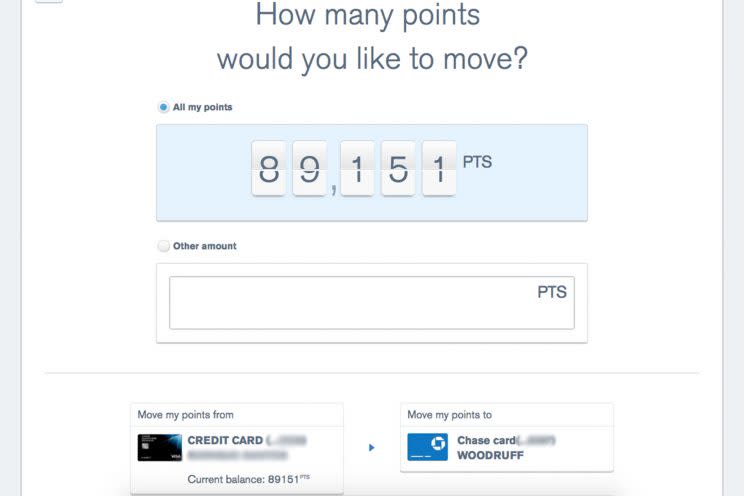

Transferring points to a single Chase Ultimate Rewards account.

To combine points, go back to the same “Combine Points” tab from the previous step. Enter the number of points you want to transfer and select the account you want.

Instantly, the points appeared in my Chase rewards account. I was pleased with the speed.

We could now use up to 200,000 Chase Ultimate Rewards points if we wanted with just a couple clicks.

Booking our flights

Start looking for deals 3-4 months out.

When you’re booking an international trip with reward points, the more flexibility you have with dates and timing, the better your chances will be to nab a great deal.

With an early April wedding date, I began shopping for flight deals the first week of January, giving us a three-month window. We kept our dates flexible — looking for a departure of anytime during the last three weeks of April.

Wait until you’re sure you want to book before transferring points.

United Airlines is one of the Chase rewards airline partners (there are seven in total, including Virgin Atlantic and Southwest Airlines) which means you can transfer points 1:1 to United to book flights. This was great for us because United has tons of European flights. But I wanted to know exactly how many points we’d need, so I didn’t transfer my points to United until the very last minute. I highly recommend this. Once you transfer Chase points to United, you can’t transfer them back.

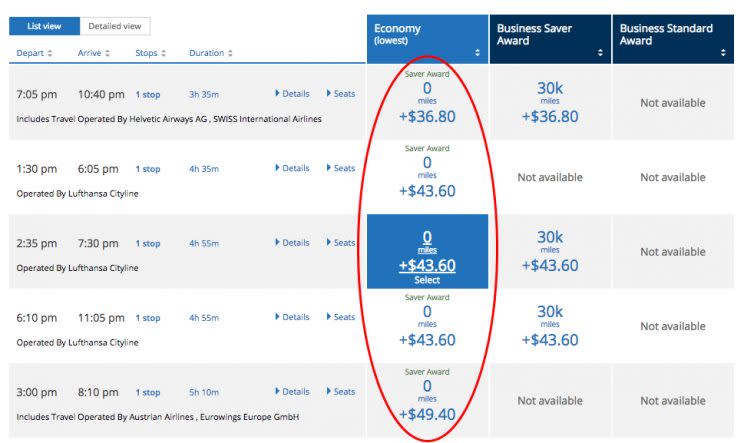

Navigating the United ‘Saver Award’ tool

To shop for awards flights on United.com, go to the main website. Check the box for “Saver Award” travel. That will show flights in terms of points/miles instead of dollars. The beauty of having flexible dates is the website will show you flight availability for the next two months all in one place. You can easily pick the window of time that has the best deals.

Blue dots vs. blue dashes: What the heck?

On the United flight page, you’ll see a calendar of dates first. Some dates will have blue dots and some will have a blue dash. Some will have both. These are important indicators. Dates with dots on them mean there are business class seats available on those dates. Dates with a plain dash mean there are only economy seats available for people booking with points.

Unfortunately, we couldn’t find any amazing deals on business class tickets during our time window. To shop different dates, just toggle from one date to the next on the calendars.

Rewards hack: Score a FREE flight to a second destination

If you’re using Chase rewards points to book flights on United, you’ve got to know about this hack. You can actually get a FREE second flight when you book an international round-trip ticket. I’m not kidding. With this perk, we were able to add an additional flight to Barcelona for 0 points, which added massive value to our trip overall. The story behind this amazing perk is that United simply allows award customers to book an extended layover… even if it’s very extended. Our stop in Barcelona will be four days!

In total we booked three flights for a 16-day trip to Italy and Spain in April.

NYC > Rome

60,000 points (30,000 points per person for economy seats)

Florence > Barcelona

0 points

Barcelona > NYC

60,000 points (30,000 points per person for economy seats)

Boo: Hidden fees

We didn’t quite get away with free flights to Europe. Fees, including some international airport taxes, are not covered by points. In total, we had to pay an additional $246.32 ($123 per person) in fees.

Still, less than $300 for round-trip international flights for two people? I’ll take that deal any day.

We also got an amazing value for the points we used. A similar itinerary would have cost roughly $1760 per person on United.com. That means we got $3,520 worth of value for only 120,000 points, which is a rate of nearly 3 cents per point. That is DOUBLE the value we would have achieved if we booked a flight through the Chase Ultimate Rewards portal. And it’s nearly triple the value we would have achieved by redeeming those 120,000 for plain old cash back.

The best part: We still have over 100,000 points left to use on hotel stays during our honeymoon or a future trip.

Grand total: 120,000 points

If I had redeemed those points for cash back, I would have netted just $1,200. I got way more value by redeeming them for flights to Europe.

But we weren’t ready to celebrate quite yet…

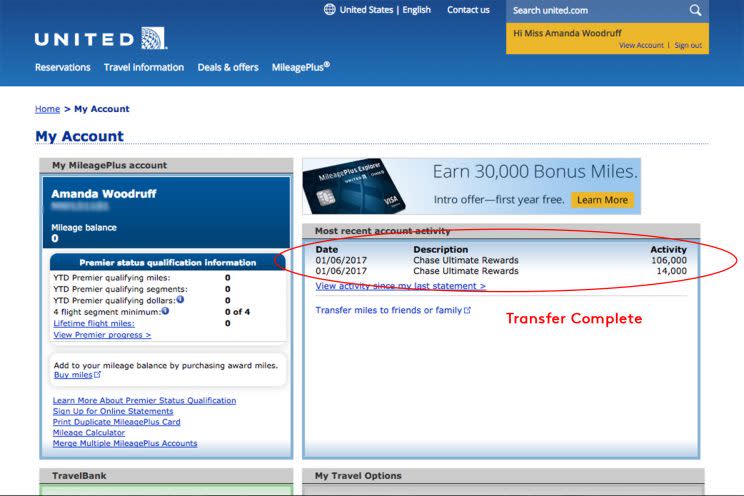

The scary part: Transferring Chase Ultimate Rewards points to our airline

Like I mentioned, we waited until we were sure we wanted to book with United and knew exactly how many points we’d need before we transferred our points. Once we had our itinerary all ready to go, I opened a new tab and went to the Chase Ultimate Rewards portal again.

In order to transfer points to a partner, you have to have an account with that partner. I signed up for a United MileagePlus account and had my member ID ready to go.

On the middle of the Chase Ultimate Rewards landing page is a section called “Ways to Redeem.” Here, you can see all the ways you can redeem points. Go to the bottom and select “Transfer to Partner.” Select the airline or hotel you want. This is when you can link your accounts using your membership ID for the airline or hotel.

Once your accounts are linked, all you have to do is punch in the number of points to transfer. I transferred exactly 120,000 to my United MileagePlus account.

The longest 30 minutes ever

The Chase website says points are usually transferred instantly, but after 10 minutes they still weren’t showing up in my United account. I called United, waited 15 minutes on hold, and finally was transferred to the booking department.

I was told points could take up to 72 hours to hit my account. I briefly panicked. What if the deal was gone by then?

Luckily, I learned United is able to put a temporary hold on seats if you ask. They offered to hold my reservation for all three flights until my points showed up.

Just as I was giving them the details for our flights, the points appeared in my account. It took roughly 30 minutes in all. I hung up and finalized the booking directly on the site.

Now, it was time to celebrate.

Hope this helps you get the most out of your Chase Sapphire Reserve points!

Mandi Woodruff is Executive Editor of MagnifyMoney.com and co-host of the Brown Ambition Podcast.

Yahoo Finance

Yahoo Finance