Honda (HMC) Q1 Earnings Miss, Sales Beat, Buyback Announced

Honda HMC reported earnings of 67 per share for first-quarter fiscal 2023, lagging the Zacks Consensus Estimate of 79 cents. The bottom line also fell from the year-ago profit of $1.18 per share. Quarterly revenues totaled $29,560 million, topping the Zacks Consensus Estimate of $27,905 million. The top line, however, contracted 9.7% year on year.

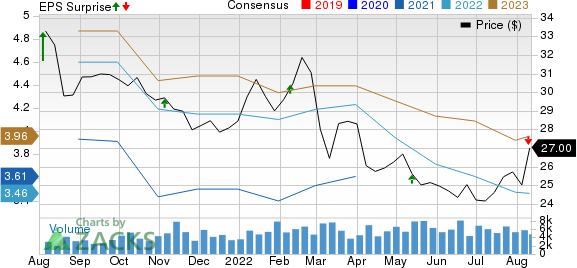

Honda Motor Co., Ltd. Price, Consensus and EPS Surprise

Honda Motor Co., Ltd. price-consensus-eps-surprise-chart | Honda Motor Co., Ltd. Quote

Segmental Highlights

For the three-month period, which ended on Jun 30, 2022, revenues from the Automobile segment increased 3.4% year over year to ¥2.32 trillion ($17.97 billion) thanks to favorable currency translations. The segment registered an operating profit of ¥38.2 billion ($295 million), plummeting 45.9% on a year-over-year basis.

Revenues from the Motorcycle segment came in at ¥676 billion ($5.21 billion), up 30.5% year over year amid an increase in sales in Asia and positive currency effects. The unit’s operating profit came in at ¥97.8 billion ($755 million), rising 21.2% year over year.

Revenues from the Financial Services segment totaled ¥750 billion ($5.79 billion), down 2.2% year on year. The unit’s operating profit, however, decreased 14.5% year over year to ¥78.8 billion ($608.34 million).

Revenues from the Power Product and Other Businesses came in at ¥119 billion ($918.6 million), up 19.9% year over year. The segment incurred an operating income of ¥7.3 billion ($56.54 million) against a loss of ¥391 million incurred in the corresponding quarter of fiscal 2022.

Financials & FY23 View

Consolidated cash and cash equivalents were ¥3.63 trillion ($27.22 billion) as of Jun 30, 2022. Long-term debt was ¥5.01 trillion ($37.62 billion).

For fiscal 2023, Honda forecasts sales of ¥16.75 trillion, implying a 15% uptick year over year. Honda projects sales volumes from Motorcycle and Automobile segments at 18.56 million units and 4.2 million units in fiscal 2023, up around 9% and 5%, respectively. Operating profit is envisioned at ¥830 billion, signaling a drop of 4.7% from fiscal 2022. Pretax profit is forecast at ¥1,040 billion, indicating a year-over-year decline of 2.8%.

The company’s R&D expenses for fiscal 2023 are likely to be ¥850 billion, suggesting a rise from ¥804 billion spent in fiscal 2022. Capex is envisioned at ¥510 billion, indicating a jump from ¥278.4 recorded in fiscal 2022.

For fiscal 2023, Honda expects a total annual dividend of ¥120 per share, including an interim and year-end dividend of ¥60 each. In a bid to enhance its capital structure, the company has decided to buy back shares up to 100 billion yen during the Aug 12, 2022 -Mar 31, 2023 time period.

Honda currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Takeaways From Toyota’s Q1 Results

Honda’s closest peer Toyota TM posted fiscal first-quarter fiscal 2023 earnings of $4.14 per share, which surpassed the Zacks Consensus Estimate of $3.77 on higher-than-expected revenues. The bottom line, however, declined from the year-ago earnings of $5.87 a share. Consolidated revenues came in at $65,543 million, beating the consensus mark of $63,653 million but contracting 9.5% year over year.TM exited the quarter with cash and cash equivalents of ¥6.68 trillion ($49.24 billion). As of Jun 30, the firm’s long-term debt amounted to ¥16.88 trillion ($124.34 billion).

For fiscal 2023, Toyota projects consolidated vehicle sales of 8.85 million, indicating an increase from 8.23 million units sold in fiscal 2022. Fiscal 2023 sales are expected to total ¥34.5 trillion, implying an increase from ¥31.4 trillion recorded in fiscal 2022 and higher than the prior view of ¥33 trillion. Operating income is projected at ¥2.4 trillion, indicating a decline of 19.8% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance