Homeowners are waiting longer to buy their next home, so they’re older

Homeowners are delaying trading up from their starter homes to save money, lifting the median age of repeat homebuyers.

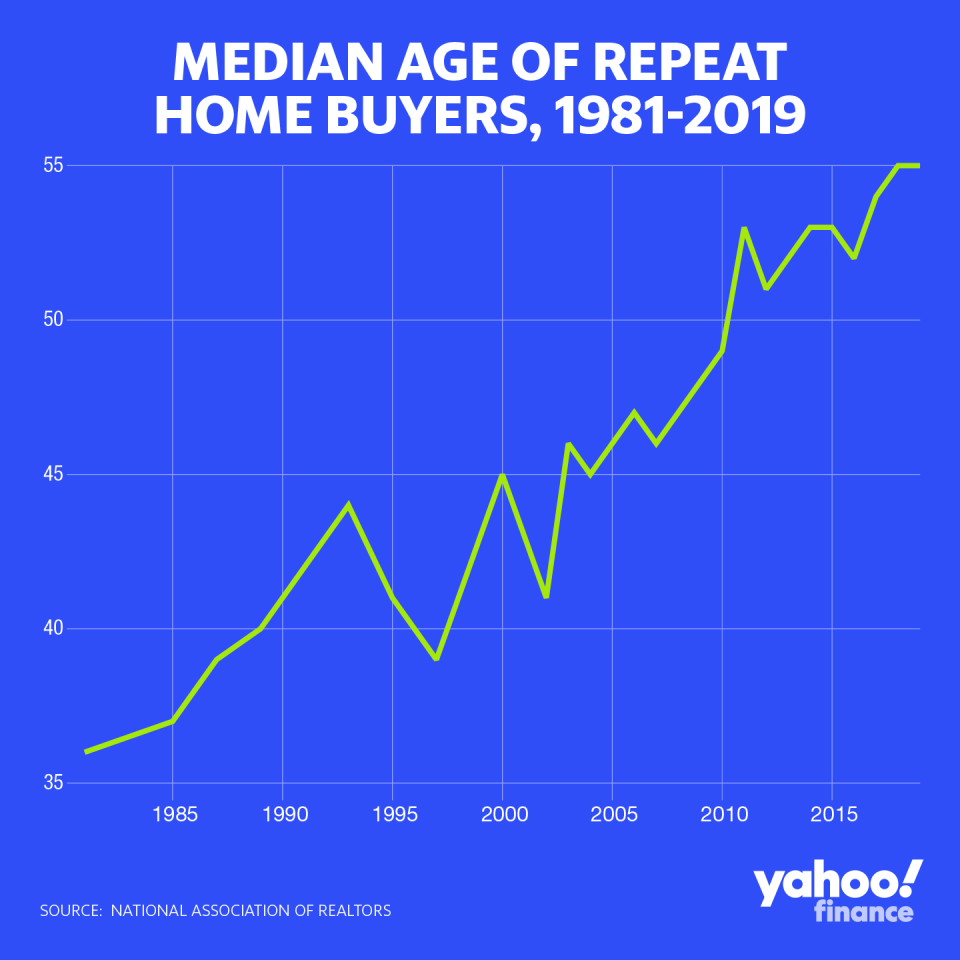

The median age of Americans who bought their next house reached age 55 in 2019, a seven-year increase from the median age of 48 in 2009, according to a study by the National Association of Realtors.

Growth had gradually ticked up from 1981 to 2009, three to five years per decade. The median age of a repeat homebuyer was 36 in 1981. Until the 2010s, the stable growth was related to a trend of homeowners trading up every six to seven years.

But today, homeowners take about 10 years to buy a new home, increasing the age of repeat buyers, said Jessica Lautz, vice president of demographics and behavioral insights at the National Association of Realtors.

A number of economic conditions conspire to create this trend of the aging homebuyer. Some delayed buying because rising home prices made a trade-up home unattainable. Other homeowners lost equity in their current home during the housing crash in 2008 so they were forced to wait until prices rose again to sell.

“Especially Gen Xers, who may have purchased during the last peak, were pushed into their home for a longer period,” said Lautz.

Plus, interest rates reached historic lows this year, dipping below 4%. Many homeowners have locked in low interest rates, incentivizing them to stick with their current mortgage.

“People are locking in low rates and staying in their homes longer. People are seeing homes as somewhere they are planning on staying,” said Lautz.

Surprisingly, the age of first-time homebuyers stayed fairly flat, reaching 33 in 2019, up from a low of 28 in 1991, according to the NAR.

“What’s really interesting here is that everyone is talking about first-time homebuyers and the lack of first time homes, but we really only see a small rise in the first time homebuyer age… The biggest rise we see is in repeat buyers,” said Lautz.

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

What to expect from the housing market in 2020

Yahoo Finance

Yahoo Finance