Home prices could fall up to 15 per cent because of COVID-19: DBRS

Coronavirus lockdowns have slowed some of the country’s biggest housing markets to a crawl.

Although prices have held relatively steady, credit ratings agency DBRS Morningstar says there’s room for prices to fall in the coming years as more homeowners fall behind on mortgage payments.

Most markets were heating up in the months leading up to the lockdowns, but the pandemic changed all of that as job losses mounted and the economy careened toward recession.

“The employment shock comes in the context of a household sector that is highly indebted; household debt-to-disposable income in Canada is 176%, which is elevated by international standards,” said DBRS Morningstar in a report.

“Notwithstanding income support programs from the federal government and mortgage deferral options from the banks, the rise in unemployment will inevitably lead more households to fall behind, and potentially default, on their mortgage payments.”

Like most predictions on the extent of the damage from COVID-19, DBRS Morningstar says the final picture is unclear. It offers a range based on possible mortgage increases in mortgage arrears.

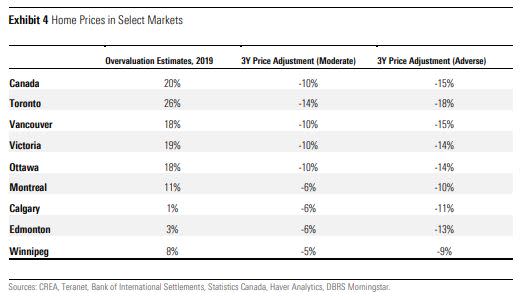

“In the moderate scenario, mortgage arrears nationwide increase to approximately 65 basis points in 2020 and then gradually decline, while home prices fall by 10% cumulatively through 2022.” said DBRS Morningstar.

“The adverse scenario features mortgage arrears rising to 100 basis points and a 15% correction in housing prices by 2022.”

Homeowners in oil-producing parts of the country are expected to struggle the most to keep up with their mortgages. But markets in those regions didn’t experience a price run-up the way others have in recent years as the energy sector struggled with low oil prices and a lack of pipelines.

On the other hand, since Toronto prices have surged so much, there’s a lot more room to fall. DRBS Morningstar says prices in Canada’s biggest city could fall 14 per cent in its moderate scenario.

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance