Home appraisal increased by almost $100,000 after Black family hid their race

CINCINNATI, Ohio -- Erica Parker tells her two daughters, "be Black and proud." She carefully decorated their rooms with drawings of Black superheroes and placed pillows with the words "Black Girl Magic" and "Black Queen" written across the front on their beds.

Erica said all she's ever wanted to teach her daughters is confidence and self-love.

That's why, she said, she couldn't hold back her tears as her daughters watched her remove every piece of Black art from their home and turn over the pillows to hide the affirming text on the front.

"I was essentially telling them to dull your Blackness when all I've ever told them is to be Black and proud. It's a mixed message to give a 6-year-old and a 3-year-old," Erica said.

What followed was a difficult conversation with her oldest about racial discrimination. A conversation Erica said she didn't want to have yet.

"I didn't want to shatter their innocence. Growing up Black, you already have so many things to deal with, and they shouldn't have to feel that so young. I was trying to be structured in how I was going to break it to them, but this situation took that away from me," Erica said.

She spent the next two hours that day overwhelmed with anger and tears as she walked the halls of her home, removing her family's pictures and replacing them with borrowed photos of her white neighbor's family.

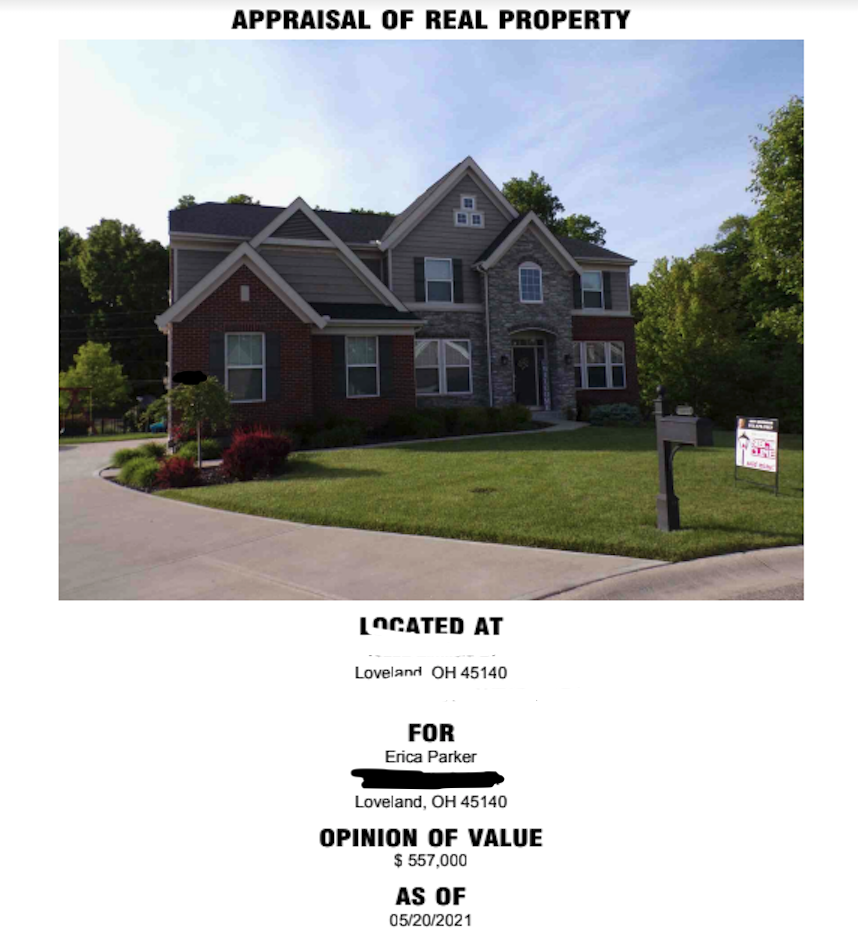

The nightmare situation Erica found herself in, she said, started with an appraisal that undervalued her home by almost $100,000 because of the color of her skin.

The family said they do not want to make the identity of the bank and the name of the appraiser public at this time.

'Right away, I knew something was wrong'

Erica and her husband Aaron Parker loved the home in Loveland, Ohio, they built seven years ago. Over time, they began considering moving their family of four to a new community.

They finally decided to list their home in March after seeing how quickly homes were selling in their neighborhood. The couple spoke with their realtor, Amy Goodman, and posted their house on Facebook.

It was like wildfire, Erica said, describing the flood of messages she received in response to the Facebook listing. A friend of the Parkers' connected them with a potential buyer who asked to see the house the same day the Facebook post went up.

"I told her she could see it, but it wasn't show-ready yet. I said 'you're going to see my house in its raw, real, I-have-kids-living-here format,'" Erica joked.

More: Black homeowner had a white friend stand in for third appraisal. Her home value doubled.

But the woman loved the home, and so did her husband, who saw it the next day. Within 24 hours, the Parkers had an offer in the low $500,000 range.

Erica and Aaron were ecstatic. So was Goodman, who expected the home would sell quickly in such a competitive market but was still surprised at how fast everything moved.

The Parkers said they began excitedly planning for their move. But what came next ended their celebratory moment, Erica said.

An appraiser came to inspect the two-story, four-bedroom, three-and-a-half bathroom home with a finished, walkout basement and fenced-in backyard. Erica said she was inside the house when the appraiser arrived and briefly spoke with him, answering his questions.

The following week, Goodman received a phone call from the buyers' realtor. He asked if she was sitting down. Goodman said she braced herself to hear bad news.

"It came in over $40,000 short. Right away, I knew something was wrong," Goodman said.

The Parkers said they initially believed the appraiser just made a mistake.

When they got a copy of the appraisal, sure enough, Erica said, they saw factual errors right away. The report had the age of the home as much older than it was, and it stated updates hadn't been made to the house, which was untrue, Erica said.

The Parkers and Goodman contacted the appraiser and showed him the mistakes. When he refused to adjust his appraisal, they said they reached out to the bank and asked them to do a new one.

"Another appraiser didn't come out. All they did was send it to a field appraiser who just reviewed the current appraisal as is. Essentially, that is like if Erica and I were coworkers, me doing something incorrectly, her reviewing it and going along with it," Goodman explained. "The field appraiser confirmed it was valid even with the errors. They acknowledged there were errors but refused to do anything about it."

The Parkers refused to sell their home for thousands less than the asking price.

"It's a competitive market. We saw homes sell for much more than the asking price. It didn't make sense. What was so different about our house? Why were we being told we had to sell for so much less?" Aaron said.

'Because of the color of our skin, people treat us differently'

When the Parkers sold a home in the past, they said they did what many other Black homeowners do: erase all evidence that the house belongs to a Black family.

"In the Black community, we know selling your home means take down your pictures. Don't be present. As soon as I told my dad about our experience, he said, 'Why was Erica home? Why didn't you take down your pictures?' He knew right away," Aaron said. "That's unfortunate."

Goodman said she also couldn't understand why the original appraisal was so low and why the bank wouldn't order a new one after they pointed out significant errors.

When it came time to do the second appraisal, the Parkers decided they would "whitewash" their home.

Erica knocked on her white neighbor's door, explained her situation, and asked to borrow his family's pictures. Then she replaced her family's photos with his.

Photos that marked special occasions in the Parkers' life, like their wedding photos and their daughters' baby pictures, were hidden in a box.

Erica couldn't hide what she is doing from her two daughters, who didn't understand why their mom was taking down their drawings from the display case she kept them in. Or why their mom was removing pictures of their smiling faces from the walls.

"That was the most crushing part of it all. To talk to your 3- and 6-year-old and explain that sometimes, because of the color of our skin, people treat us differently. I explained to her (the oldest) we're going to give people grace and assume that's not the case, but that mommy and daddy are testing something out to see if that was happening and if it was, we'd take care of it," Erica said.

Before the appraiser arrived, the Parkers took their kids and left home. Only Goodman, who is white, was there to greet him.

A week later, the second appraisal came back. It was almost $100,000 higher than the first one, Goodman said.

"We were so happy until we realized what just happened. Then, it was a really dark moment," Erica said.

The second appraisal came in at $557,000, $92,000 higher than the initial appraisal.

The Parkers said their fears that the low appraisal was due to racial discrimination was confirmed as they realized how easily they could have lost almost $100,000 on their home.

'Major institutions that drive wealth in this country systemically devalue Black assets'

Andre Perry, a senior fellow for the Brookings Metropolitan Policy Program, worked on a study to understand how much money majority-Black communities are losing in the housing market stemming from racial bias.

Perry said homes in Black neighborhoods are undervalued by $48,000 per home on average, amounting to $156 billion in cumulative losses.

The study also found metropolitan areas with greater devaluation of Black neighborhoods are more segregated and produce less upward mobility for the Black children who grow up in those communities.

"I expected to find gaps when doing this study, but I didn't expect them to be so large. We're talking hundreds of billions of dollars being lost. That's just an indictment of the American Dream and the very notion of fairness. Major institutions that drive wealth in this country systemically devalue Black assets," Perry said.

He said the Parkers' experience highlights how strong an impact racial bias can have on one's financial future and the intrinsic value whiteness plays in our society. It's a shame, he said, of how greatly the outcome changed once the Parkers replaced their family photos with a white family.

Perry found through his research that Black neighborhoods and homes are perceived as having less value or being worse automatically.

"Those perceptions are not only with appraisers but with lenders and real estate agents. When they evaluate risk, they don't see it the same way compared to a white person. That's why there's a need for more accountability," Perry said. "I think it's one of those things people have learned to live with."

He said there needs to be more transparency around the data for home appraisals, accountability for lenders, and a new model to evaluate homes.

The United States Department of Housing and Urban Development said they are taking new action on appraisal bias.

In a statement to the USA TODAY Network, officials with HUD said this type of discrimination leads to further inequality.

"Homeownership is the principal source of wealth for most American households and properly setting a home's value is critical to wealth creation for families and communities. The devaluation of property makes a family least likely to build or pass intergenerational wealth to children," officials said.

Over the summer, under HUD Secretary Marcia Fudge, the agency launched the interagency Property Appraisal Valuation Equity task force to combat appraisal discrimination.

More: A historic housing crisis has America in its grip. Can Marcia Fudge save the day?

Over the next six months, the task force will examine the cause and consequences of the undervaluation of properties.

Officials said the task force plans to combat valuation bias by educating consumers and practitioners and making appraisal data more available.

The agency also plans to create a comprehensive approach to combating valuation bias through enforcement, compliance, and other efforts.

'People always doubt you'

Goodman said she had never encountered a situation like this before. She said it is normal for appraisals to miss by $10,000, maybe even $20,000, but she's never seen an almost $100,000 difference.

The ordeal the Parkers went through, Goodman said, was very eye-opening for her. That's why, she said, she's working to educate herself on appraisal discrimination and hopes to bring attention to the issue.

The Parkers said they believe appraisal discrimination happens often, but many reasons prevent people from speaking out.

"People always doubt you. Since we've shared our story, it's been thrown out there, and probably will continue, that it was just one bad appraiser. And you can always say 'it's just one bad apple' we hear that all the time. But even if it's still partially true, the lender in our case didn't hear our concerns and order another appraisal," Aaron said.

An issue becomes systemic when those with the power to stop discrimination turn a blind eye to it, and in their case, the bank didn't intervene, he said.

Erica said another reason people don't speak out and fight back in these cases is they might not have the means to do so. She explained the obstacles they faced, like hiring an appraiser out of their pocket, whitewashing their home, and delaying the selling process.

"Also, people are just tired. Being Black in America is tiring. You have to figure out what you're going to battle because if you battle everything, you're going to be fighting every day," Erica said.

The Parkers were able to eventually sell their home.

The family is now working toward getting settled in their new community.

There were a lot of considerations the couple made before going public with their experience. They worried about how it could impact their careers in the future or the attention it could bring to their family.

But they decided they needed to speak out for their family.

"We have two young daughters we want to show racial discrimination isn't OK. And you can fight back," Erica said.

The family hopes to see legislation introduced to change the appraisal process and hold banks accountable for discriminatory practices.

The Parkers have filed a complaint with HUD. They've also attained legal representation and are working to determine their next steps legally, they said.

To file a complaint with HUD, visit https://pave.hud.gov/complaint.

This article originally appeared on Cincinnati Enquirer: Home appraisal grew almost $100,000 after Black family hid their race

Yahoo Finance

Yahoo Finance