Some Hollysys Automation Technologies (NASDAQ:HOLI) Shareholders Have Copped A Big 51% Share Price Drop

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Hollysys Automation Technologies Ltd. (NASDAQ:HOLI), since the last five years saw the share price fall 51%. And it's not just long term holders hurting, because the stock is down 29% in the last year. Furthermore, it's down 14% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Hollysys Automation Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

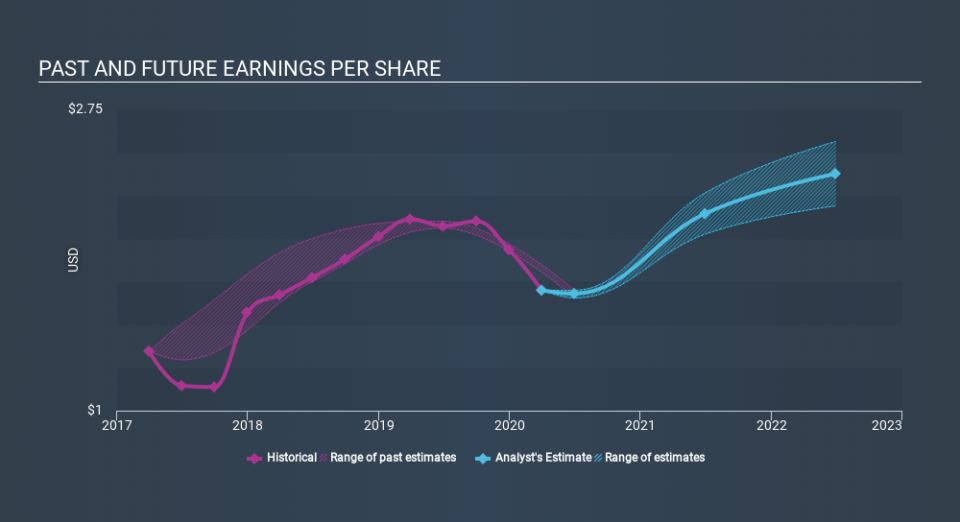

During the five years over which the share price declined, Hollysys Automation Technologies's earnings per share (EPS) dropped by 0.01% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 13% per year, over the period. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 7.40.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Hollysys Automation Technologies's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hollysys Automation Technologies's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Hollysys Automation Technologies shareholders, and that cash payout explains why its total shareholder loss of 49%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in Hollysys Automation Technologies had a tough year, with a total loss of 28% (including dividends) , against a market gain of about 6.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before deciding if you like the current share price, check how Hollysys Automation Technologies scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance