Should You Be Holding Games Workshop Group PLC (LON:GAW)?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of Games Workshop Group PLC (LON:GAW), it is a company with great financial health as well as a a strong track record of performance. Below is a brief commentary on these key aspects. If you're interested in understanding beyond my broad commentary, take a look at the report on Games Workshop Group here.

Flawless balance sheet with proven track record

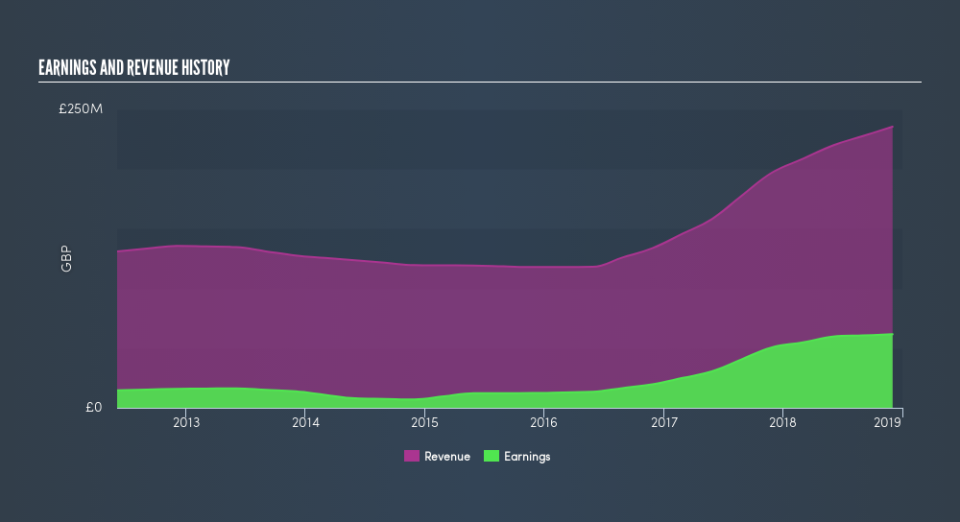

GAW has a strong track record of performance. In the previous year, GAW delivered an impressive double-digit return of 61% Not surprisingly, GAW outperformed its industry which returned 14%, giving us more conviction of the company's capacity to drive bottom-line growth going forward. GAW's ability to maintain an adequate level of cash to meet upcoming liabilities is a good sign for its financial health. This suggests prudent control over cash and cost by management, which is a key determinant of the company’s health. Investors should not worry about GAW’s debt levels because the company has none! This implies that the company is running its operations purely on off equity funding. which is typically normal for a small-cap company. Therefore the company has plenty of headroom to grow, and the ability to raise debt should it need to in the future.

Next Steps:

For Games Workshop Group, I've put together three fundamental factors you should further examine:

Future Outlook: What are well-informed industry analysts predicting for GAW’s future growth? Take a look at our free research report of analyst consensus for GAW’s outlook.

Valuation: What is GAW worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether GAW is currently mispriced by the market.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of GAW? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance