Can Higher Throughput Aid HollyFrontier's (HFC) Q3 Earnings?

HollyFrontier Corporation HFC is set to release third-quarter 2019 results before the opening bell on Thursday, Oct 31. The current Zacks Consensus Estimate for the to-be reported quarter is a profit of $1.43 on revenues of $4.3 billion.

The Zacks Consensus Estimate for third-quarter earnings has been revised upward 7.5% in the past 30 days. Given this backdrop, let’s delve into the factors that might have influenced the company’s performance in the September quarter.

Factors to Consider This Quarter

Certain factors which have a strong influence on HollyFrontier’s Refining segment are sending mixed signals with regard to the company’s results in the third quarter.

The Zacks Consensus Estimate for refined products sales volume is pegged at 472 thousand barrels per day (mbpd), indicating an increase from 447.8 mbpd reported in the third quarter of 2018. In the second quarter, HollyFrontier averaged around 469.1 mbpd. Moreover, throughput volume is likely to have improved to about 484 mbpd from 470.6 mbpd last year, while operating expenses per barrel most likely fell by 11.9% over the same period to $5.60 per barrel.

But on a bearish note, the Zacks Consensus Estimate for gross refining margin in HollyFrontier’s Mid-Continent region – the company’s largest – is pegged at $13.49 per barrel, down from $16.43 in the corresponding quarter of 2018. Consequently, HollyFrontier is likely to have experienced a 27.4% year-over-year decrease to net operating margin to $9.48 a barrel.

As a result, the company’s third-quarter income from the Refining segment – the main contributor to HollyFrontier earnings – is pegged at $306 million, compared with $418.5 million in the corresponding period of 2018.

Meanwhile, strong gathering volumes are expected to get reflected in the midstream segment bottom-line number, which may have increased 4.9% year over year to $66 million. On the other hand, the company’s Lubricants and Specialty Products segment is likely to have performed badly in third-quarter 2019 on base oil market weakness. Segment income is pegged at $18 million, down from $31.2 million in third-quarter 2018.

What Does Our Model Say?

The proven Zacks model does not conclusively show that HollyFrontier is likely to beat estimates this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: HollyFrontier has an Earnings ESP of 0.00%. This is because both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at $1.43.

Zacks Rank: HollyFrontier carries a Zacks Rank of 3, which increases the predictive power of ESP.

Highlights of Q2 Earnings & Surprise History

In the last reported quarter, the Dallas, TX-based company beat the consensus mark on stronger refining margins. HollyFrontier reported adjusted net income per share of $2.18 that surpassed the Zacks Consensus Estimate by 51 cents and was 50.3% above the year-ago profit.

Revenues of $4.8 billion surpassed the Zacks Consensus Estimate of $4.6 billion and rose 7% from the second-quarter 2018 sales of $4.5 billion.

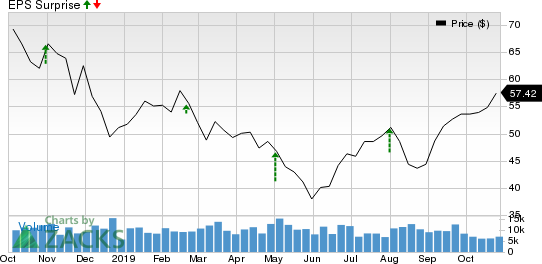

As far as earnings surprises are concerned, the downstream operator is on an excellent footing, having gone past the Zacks Consensus Estimate in each of the last four reports. This is depicted in the graph below:

HollyFrontier Corporation Price and EPS Surprise

HollyFrontier Corporation price-eps-surprise | HollyFrontier Corporation Quote

Stocks to Consider

While earnings beat looks uncertain for HollyFrontier, here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this season:

Continental Resources, Inc. CLR has an Earnings ESP of +4.6% and is Zacks #3 Ranked. The company is anticipated to release earnings on Oct 30.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Gulfport Energy Corporation GPOR has an Earnings ESP of +3.57% and a Zacks Rank #3. The company is anticipated to release earnings on Oct 31.

Concho Resources, Inc. CXO has an Earnings ESP of +1.91% and is Zacks #3 Ranked. The company is anticipated to release earnings on Oct 29.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HollyFrontier Corporation (HFC) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Gulfport Energy Corporation (GPOR) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance