This High-Yield Oil Giant Could Offer Retirees Sustainable Income

Integrated oil and natural gas giant Royal Dutch Shell plc (NYSE: RDS-B) is making impressive progress as it comes back from the worst of the oil downturn that started in mid-2014. It's not only making notable progress on the balance sheet, but it's also improving the returns it's getting on its shareholders' money. If you are a retiree looking for sustainable income, Shell and its 6% yield could be just what you're looking for.

Shell's leverage issues

One of the big problems for Shell today is debt. At the end of 2014, long-term debt stood at roughly $38 billion. Debt peaked at nearly $87 billion in the third quarter of 2016. Some of that was related to the energy downturn, during which oil companies used their balance sheets to support capital spending and dividends. For example, ExxonMobil's (NYSE: XOM) long-term debt load rose from $11.6 billion at the end of 2014 to a high of nearly $30 billion in early 2016.

Image source: Getty Images.

There are a couple of caveats to this comparison. First, Shell tends to hold much more cash than Exxon. A the end of the second quarter, Exxon had $4 billion in cash and Shell had $23 billion. So Shell's debt load isn't as onerous as it may at first seem compared to Exxon. And then there's the fact that Shell made a massive $50 billion acquisition (BG Group) in 2016, which was the real driver of the company's increasing debt load. Exxon made some purchases, but nothing on that scale.

The solution

Almost as soon as Shell completed the deal, however, it announced plans to sell $30 billion worth of non-core assets to help pay down debt. The oil giant has already trimmed debt by around $6 billion (nearly 7%) from its peak. And there are more debt repayments to come, since the company has agreed to or completed $25 billion worth of dispositions. Management is clearly living up to its word on this one.

Debt reduction, however, is only half the story. The BG acquisition was an opportunistic move to shift Shell's business so it could better compete in a fast-changing energy market. That included increasing the company's exposure to natural gas and adding growth opportunities in deepwater drilling. And, of course, the ability to sell off less-desirable assets, like the resent sale of its stake an an Irish gas field. But the real number to watch is return on capital employed, a measure of how well Shell invests its shareholders' money.

Shell has long been a laggard when it comes to returns on capital employed, another big issue for the company. Poor results have been driven by notable investment mistakes like the failed attempt to explore for oil in the Arctic. Return on capital employed actually sunk into negative territory in 2016, but it has since started to turn higher.

RDS.B Return on Capital Employed (TTM) data by YCharts.

That's partly because of oil prices increasing from their lows to around $50 a barrel and partly due to the changes Shell has been making. Management believes it can get its return on capital employed as high as 10% as it continues the corporate overhaul. That is the type of improvement that will allow the oil major to keep paying its dividend well into the future. The BG deal that helped drive up the company's debt load was a key part of achieving that goal.

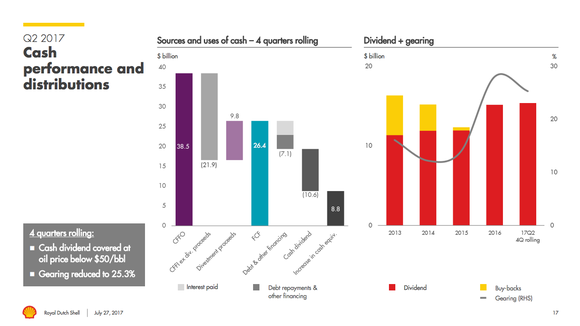

Meanwhile, higher oil prices have vastly improved the company's business today. Notably, Shell generated enough cash to cover its dividend over the last four quarters despite oil remaining at less than half its peak 2014 levels. So the dividend looks sustainable today and even more sustainable in the future as the BG acquisition helps to reposition Shell for the future.

Shell covered its dividend over the last four quarters. Image source: Royal Dutch Shell plc.

Add it all up, and the story is clearly getting much better at Shell, which explains why Shell's stock price is up near a 52-week high. The dividend yield, however, is still relatively high compared to the company's own history and well above what you can get from an investment in an S&P 500 Index fund. Shell is probably trading at a fair price for what you are getting, but you are still getting paid very well to watch the company's corporate overhaul unfold.

Worth the cost

If you're looking for a large and sustainable yield, Shell appears to be a good option. It's making progress on its debt reduction plans and the BG acquisition has helped it shift its business to better compete. The evidence of that is already showing up in the return on capital employed. It's not exactly a steal today, but retirees looking for sustainable income should take a closer look at high-yielding Shell. It's better to pay a fair price for a good company than miss this opportunity.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Reuben Gregg Brewer owns shares of ExxonMobil. The Motley Fool owns shares of ExxonMobil. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance