Here's Why We're Not Too Worried About American Manganese's (CVE:AMY) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, American Manganese (CVE:AMY) stock is up 1,192% in the last year, providing strong gains for shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So notwithstanding the buoyant share price, we think it's well worth asking whether American Manganese's cash burn is too risky. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for American Manganese

How Long Is American Manganese's Cash Runway?

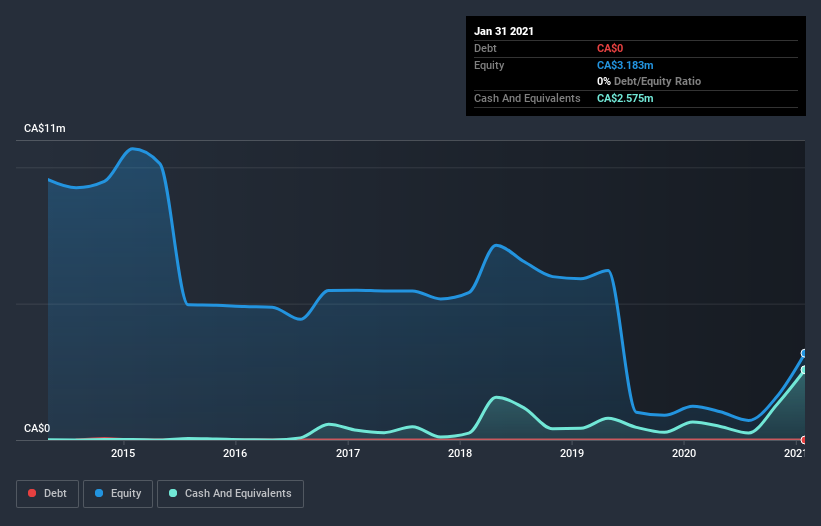

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at January 2021, American Manganese had cash of CA$2.6m and no debt. Looking at the last year, the company burnt through CA$1.2m. So it had a cash runway of about 2.1 years from January 2021. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

How Is American Manganese's Cash Burn Changing Over Time?

American Manganese didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. With cash burn dropping by 9.3% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Admittedly, we're a bit cautious of American Manganese due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can American Manganese Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for American Manganese to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CA$324m, American Manganese's CA$1.2m in cash burn equates to about 0.4% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is American Manganese's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way American Manganese is burning through its cash. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. Its weak point is its cash burn reduction, but even that wasn't too bad! Looking at all the measures in this article, together, we're not worried about its rate of cash burn, which seems to be under control. On another note, American Manganese has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance