Here's Why I Think Textainer Group Holdings (NYSE:TGH) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Textainer Group Holdings (NYSE:TGH). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Textainer Group Holdings

How Fast Is Textainer Group Holdings Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Textainer Group Holdings's stratospheric annual EPS growth of 58%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Textainer Group Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Unfortunately, Textainer Group Holdings's revenue dropped 5.9% last year, but the silver lining is that EBIT margins improved from 32% to 35%. That's not ideal.

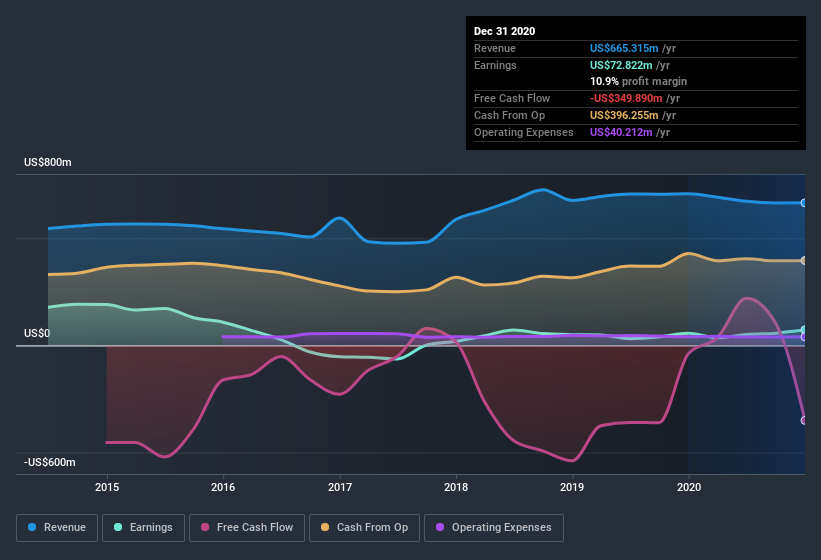

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Textainer Group Holdings's forecast profits?

Are Textainer Group Holdings Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Textainer Group Holdings shares worth a considerable sum. Notably, they have an enormous stake in the company, worth US$132m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Textainer Group Holdings To Your Watchlist?

Textainer Group Holdings's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Textainer Group Holdings for a spot on your watchlist. We should say that we've discovered 2 warning signs for Textainer Group Holdings (1 is potentially serious!) that you should be aware of before investing here.

Although Textainer Group Holdings certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance