Here's Why We Think Peyto Exploration & Development (TSE:PEY) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Peyto Exploration & Development (TSE:PEY). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Peyto Exploration & Development

How Fast Is Peyto Exploration & Development Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Peyto Exploration & Development's EPS has grown 24% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

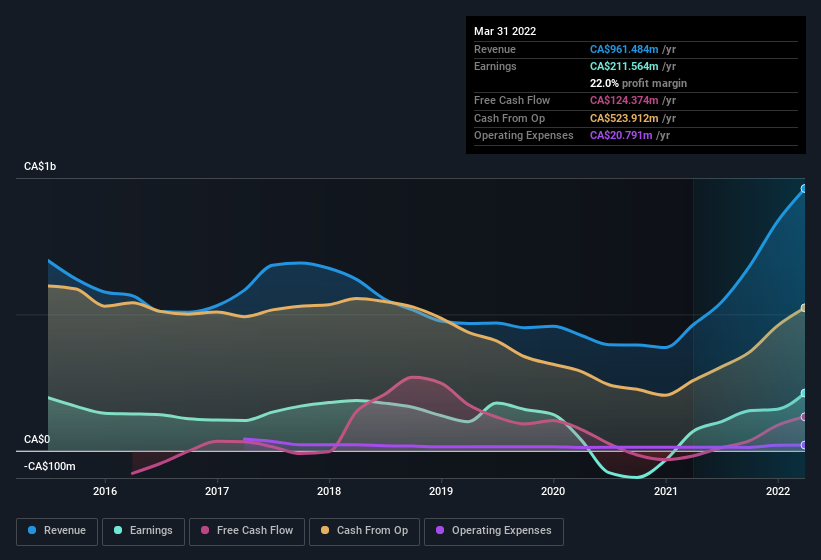

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Peyto Exploration & Development is growing revenues, and EBIT margins improved by 15.0 percentage points to 33%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Peyto Exploration & Development's future profits.

Are Peyto Exploration & Development Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold -CA$968k worth of shares. But that's far less than the CA$5.0m insiders spend purchasing stock. This makes me even more interested in Peyto Exploration & Development because it suggests that those who understand the company best, are optimistic. We also note that it was the President & COO, Jean-Paul Lachance, who made the biggest single acquisition, paying CA$351k for shares at about CA$15.60 each.

The good news, alongside the insider buying, for Peyto Exploration & Development bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping CA$88m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Darren Gee is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Peyto Exploration & Development with market caps between CA$1.3b and CA$4.1b is about CA$2.9m.

The CEO of Peyto Exploration & Development only received CA$1.3m in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Peyto Exploration & Development To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Peyto Exploration & Development's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 5 warning signs for Peyto Exploration & Development (of which 1 is potentially serious!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Peyto Exploration & Development, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance