Here's Why We Think Canadian Western Bank (TSE:CWB) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Canadian Western Bank (TSE:CWB), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Canadian Western Bank

Canadian Western Bank's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Canadian Western Bank grew its EPS by 7.4% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

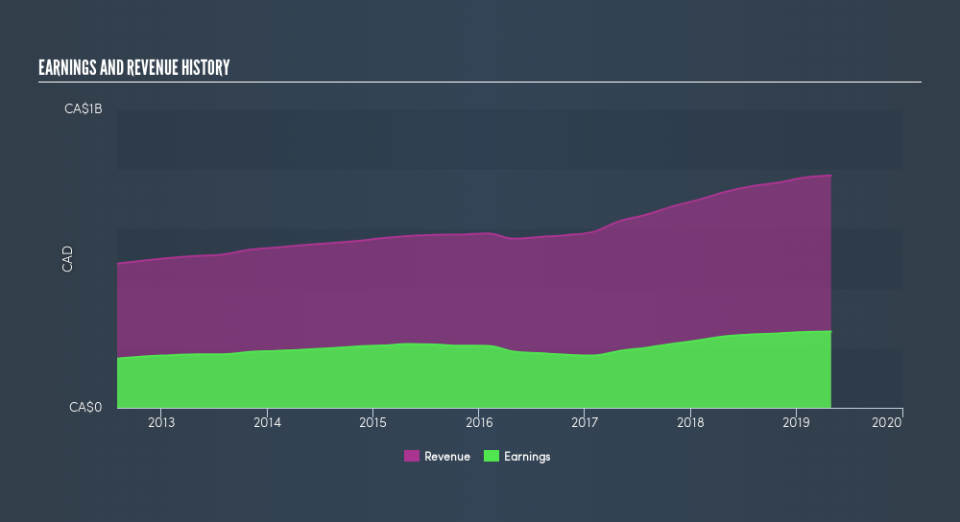

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Canadian Western Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Canadian Western Bank's EBIT margins were flat over the last year, revenue grew by a solid 7.6% to CA$779m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Canadian Western Bank EPS 100% free.

Are Canadian Western Bank Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite -CA$282.7k worth of sales, Canadian Western Bank insiders have overwhelmingly been buying the stock, spending CA$704k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was E. Mitchell who made the biggest single purchase, worth CA$100k, paying CA$29.73 per share.

Should You Add Canadian Western Bank To Your Watchlist?

One important encouraging feature of Canadian Western Bank is that it is growing profits. Not every business can grow its EPS, but Canadian Western Bank certainly can. The gravy on the mushroom pie is the insider buying, which has me tasting potential opportunity; one for the watchlist, I'd posit. Of course, just because Canadian Western Bank is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Canadian Western Bank is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance